All Eyes on BOJ As USDJPY Holds Firm

USDJPY Holds Near Highs

Despite a brief dip lower yesterday, as traders digested the details of the latest US inflation data and the FOMC meeting afterward, USDJPY has recovered today with the pair once again creeping back towards highs. Although US inflation was seen cooling again last month, Powell warned that inflation was still too high and that further work was needed.

Hawkish Fed Shift

The Fed revised its inflation outlook for this year and next year higher along with cutting its projected number of rate-cuts this year to 1 from 3 previously. Near-term, much will hinge on how inflation develops, meaning the Fed could turn more dovish again if inflation starts to cool more quickly. However, if inflation remain sticky at current levels or turn higher, this could see easing being delayed until next year.

BOJ Up Next

Away from the Fed and USD, focus this week will also be on the BOJ meeting on Friday, with options market pricing showing that traders sense the risk of fresh action from the BOJ. Japanese authorities have continued to jawbone against a weaker JPY recently but have yet to intervene again. A fresh cut in bond purchases is the expected move tomorrow though JPY might not trade much lower with anything less than a fresh rate hike, putting greater focus on the bank’s messaging and guidance.

Technical Views

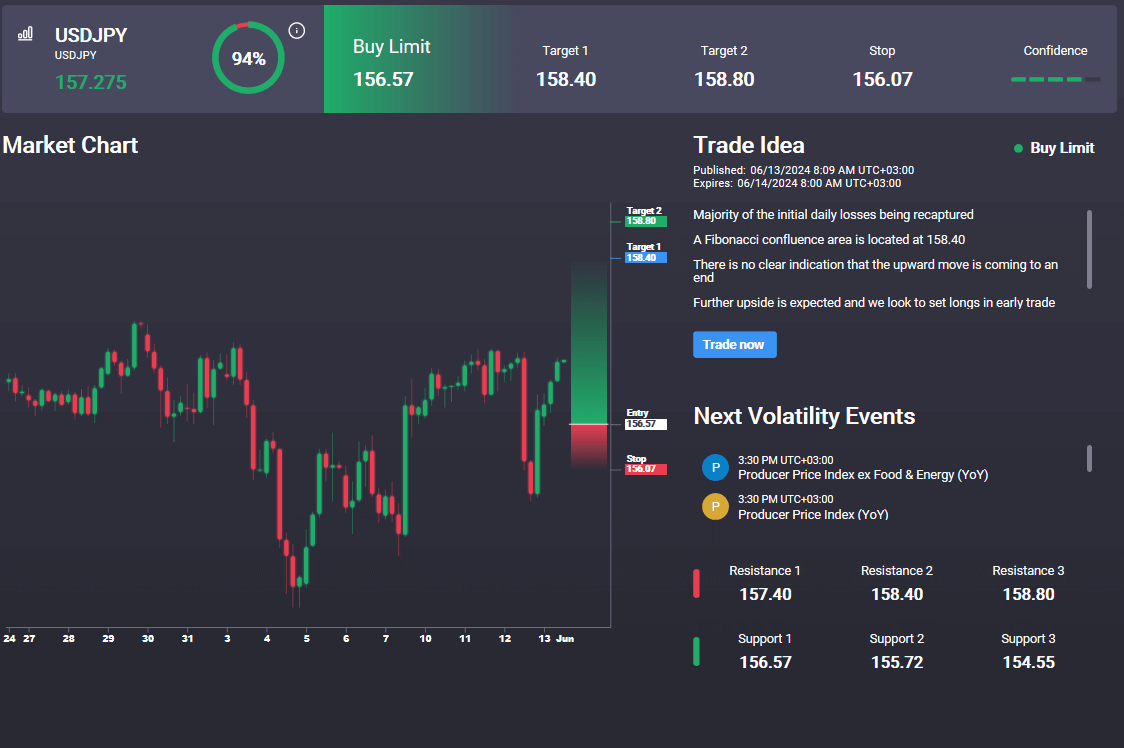

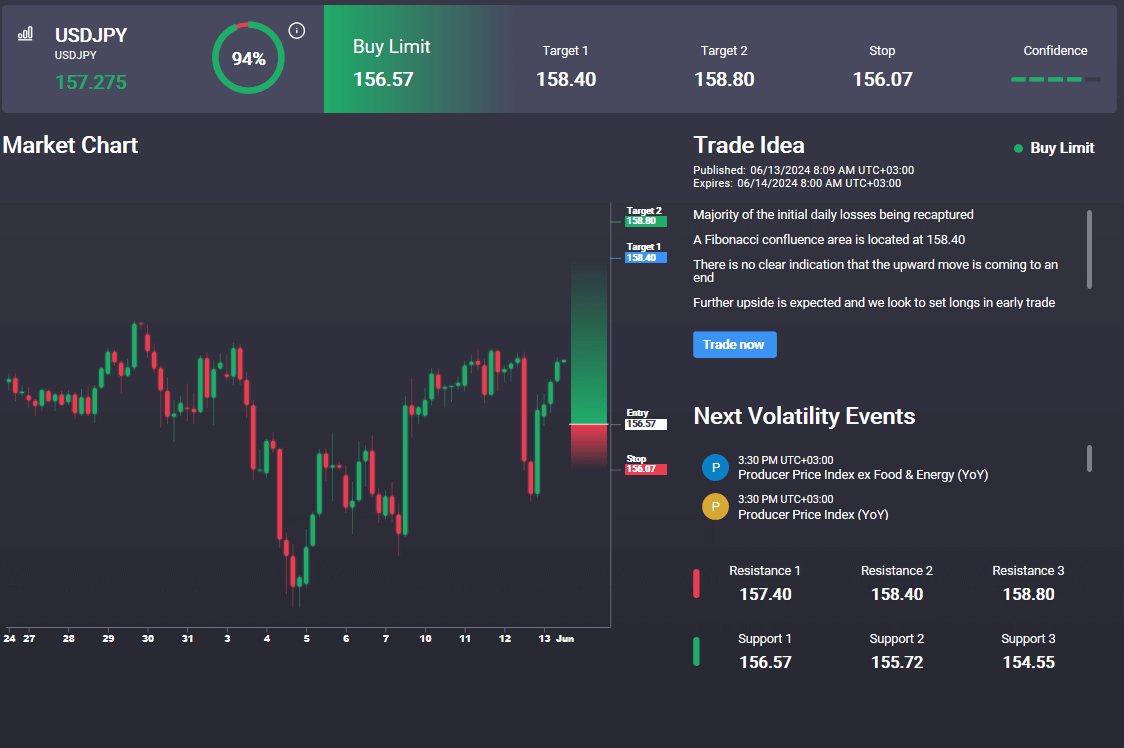

USDJPY

For now, USDJPY remains well within the bull channel though still capped by the 158.28 level resistance. 156.18 holds as support and with momentum studies turning higher, focus is on a fresh test of current highs. To the downside, if we break the channel, 151.81 will be next key support to watch. In the Signal Centre today, we have a buy limit set at156.57 suggesting a preference to stay long into any dips lower.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.