Bitcoin Bounces Off Support - Big Test Ahead

BTC Bouncing on Monday

Bitcoin futures are looking a little more encouraging for bulls as we kick off the first week of H2. The market has rallied off last week’s lows, currently trading around 9% off the June lows in line with the pullback we’re seeing in USD. A hawkish shift from the Fed over the last month has been the main driver of the correction lower we’ve seen in Bitcoin. Diminished easing expectations for 2024 have fuelled net-outflows from BTC ETF’s over recent weeks, weighing on prices. Looking ahead this week, however, BTC might be on the verge of a comeback story.

Bullish BTC Opportunities

The big focus for traders this week will be the latest US jobs data due on Friday. In line with weakening inflation readings (CPI and PCE), traders sense that a further softening of jobs data could lead to some near-term unwinding of USD as traders rebuild their September rate-cut expectations. In this scenario, BTC stands to benefit nicely on the back of the recent order-book clear out we’ve seen, paving the way for a move back up to highs. The rally could be particularly strong if we see a firm downside surprise in Friday’s data.

Bearish BTC Risks

On the other hand, if Friday’s data surprises to the upside, this could be very bearish for BTC. September rate-cut chances are still seen as very much 50-50 and an upside surprise could see those chances falling fast, leading USD higher and weighing on BTC and the broader risk complex.

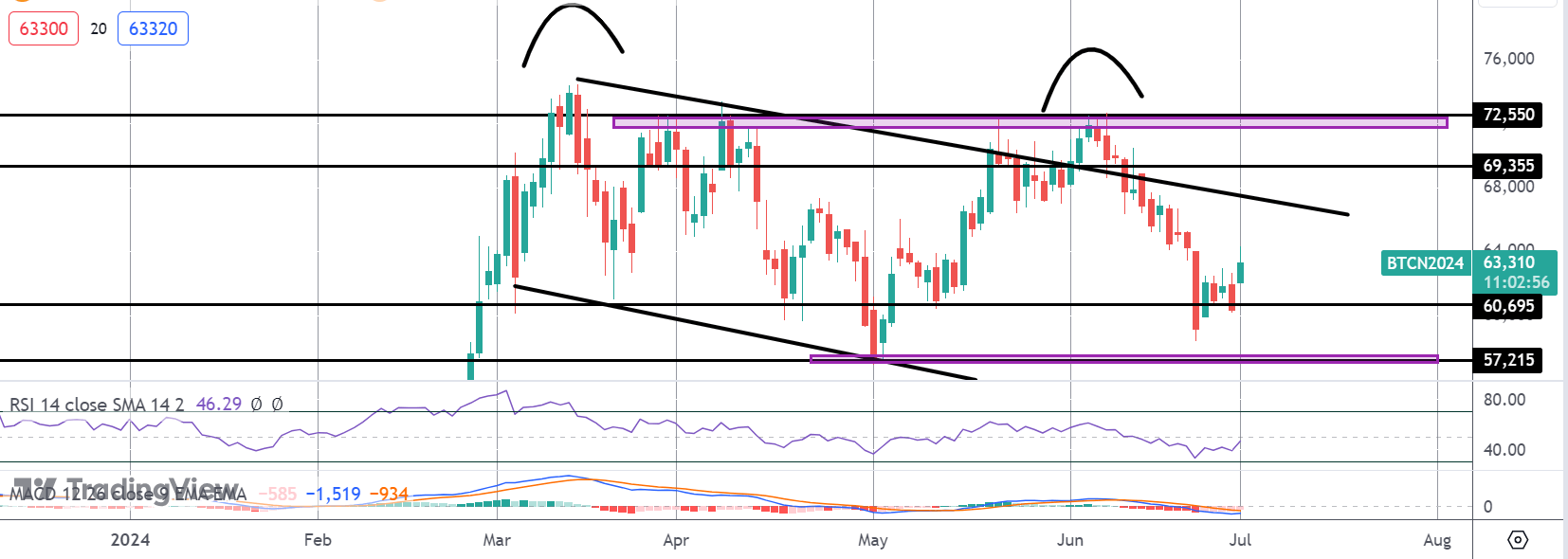

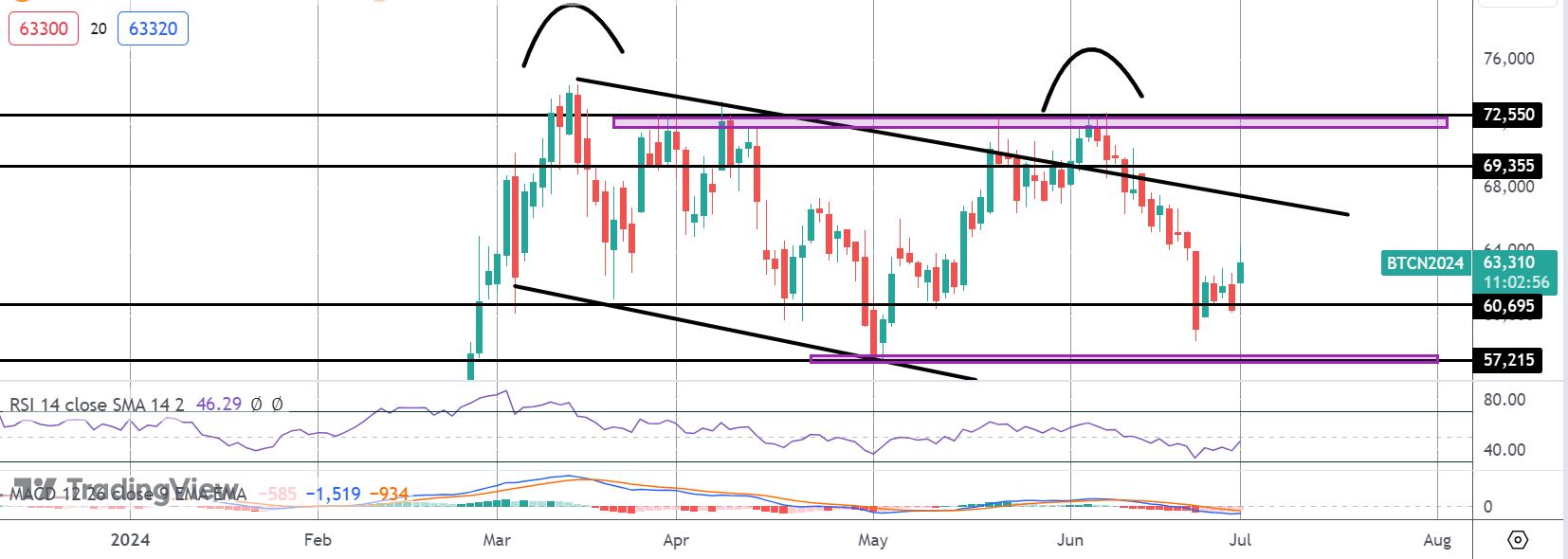

Technical Views

BTC

The sell-off in BTC has stalled for now into a test of support at the 60.695 level. Price is now bouncing and with momentum studies turning higher bulls will be looking to lead a move back up towards the 69,355 level first, with the bear channel highs coming in just ahead. To the downside, 57,215 remains key support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.