Cautious Fed Tone Fuels Risk Taking. What’s Next for EURUSD, GBPUSD?

The Fed took another timid step towards tightening monetary policy at yesterday's meeting. The Central Bank also acknowledged that increased inflation may linger longer than originally anticipated. However, judging by the reaction of the dollar and bonds, the markets expected more aggressive rhetoric.

The Fed noted yesterday that the economy is heading in a direction that implies a move towards tighter credit conditions, but Powell said it will take a little more time to be convinced of the success of employment growth. Clearly, the debate over when to start cutting the $120bn QE is heating up, but it is unlikely that the Fed will formally announce it before December. Also yesterday's meeting revealed a few details about how the QE cut will take place. By all appearances, the sale of MBS from the balance sheet will be carried out last, however, the monthly rate of purchase of Treasuries will decrease faster than MBS. However, market interest rates have been wary of the Fed's seemingly hawkish communication:

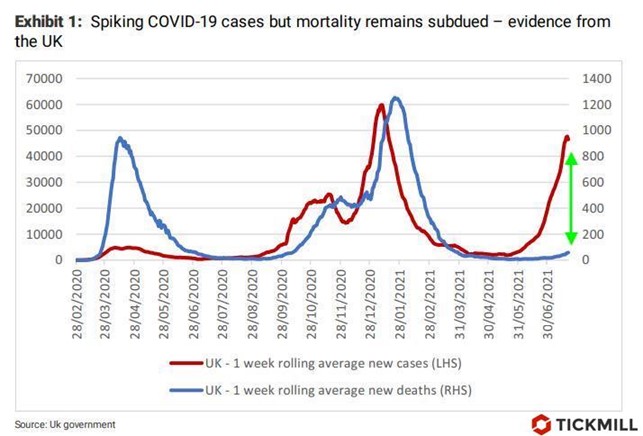

In addition, comments on inflation and the third wave of covid were more optimistic than anticipated. Powell reiterated its view that current high inflation is temporary however he also noted noted that there are risks of its acceleration. The increase in the number of new cases of Covid-19, according to Powell, calls for caution, but there is still no consensus on the economic damage from the third wave. The balance of optimism and caution in the Fed's communication leaves room for the regulator to shift to expectations that the federal funds rate hike will begin in 2022. Market expectations price in the first rate hike no earlier than 2023.

The dollar continued to decline after the Fed meeting in line with the idea discussed yesterday. Markets were obviously expecting a more hawkish stance from the Fed in view of the latest developments in US inflation, but instead they saw an extension of the wait-and-see attitude. The dollar index fell to a monthly low of 92 points, EURUSD rose to a two-week high, and GBPUSD was at a one-month high, due to increasing divergence of the policies of the Bank of England and the Fed. Recall that the Bank of England continues to lean towards the need to start raising rates, since the risks of economic damage from the third wave of covid, even after the complete removal of social restrictions, are decreasing. This is indicated by the growing gap in the rate of daily growth of new cases of Covid-19 after the lifting of restrictions and the rate of hospitalisation:

German inflation and US GDP data for the second quarter are due later today. Moderate pressure on the US dollar is expected to develop if the data exceeds expectations, as it will show that the Fed's dovish stance continues to be coupled with strong economic expansion in key developed economies, resulting in increased demand for risk.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.