Crude Drops Lower As Demand Fears Rise Up

Demand Woes Weigh on Crude

Crude prices are stabilising today after dropping sharply yesterday. Crude futures fell almost 5%, trading down to their lowest level since early May before buyers stepped in to stem the decline. The move lower was primarily driven by fresh demand concerns. On the back of the EIA last week projecting a higher level of global supply this year than previously thought, traders are weighing up the likely impact of higher supply and reduced demand, which is expected to keep crude prices pressured lower near-term.

USD Key to Watch

The US Dollar is a key driver to monitor, however. While USD had been higher into the end of May. The correction lower in recent weeks suggests room for a move higher in oil particularly if USD resolves properly to the downside. Such a move might come in response to tomorrow’s FOMC meeting. If the Fed holds rates steady and strikes a less hawkish outlook than many are expecting, this could easily fuel a short squeeze in oil and other commodities near-term. On the other hand, if the Fed pushed ahead with a pause on rates but strikes a firmly hawkish tone, keeping future rate-hike expectations primed, crude might well fall further near-term.

Technical Views

Crude

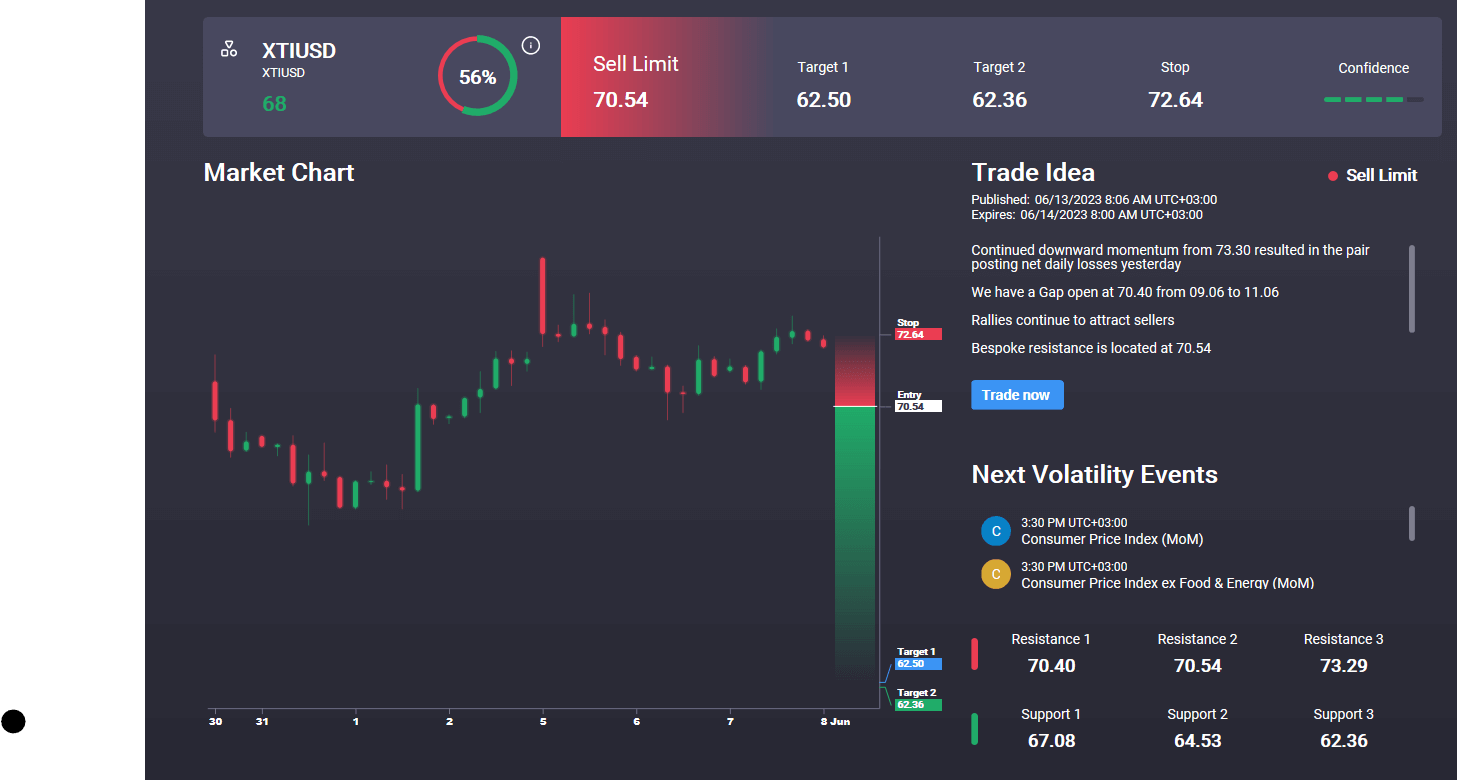

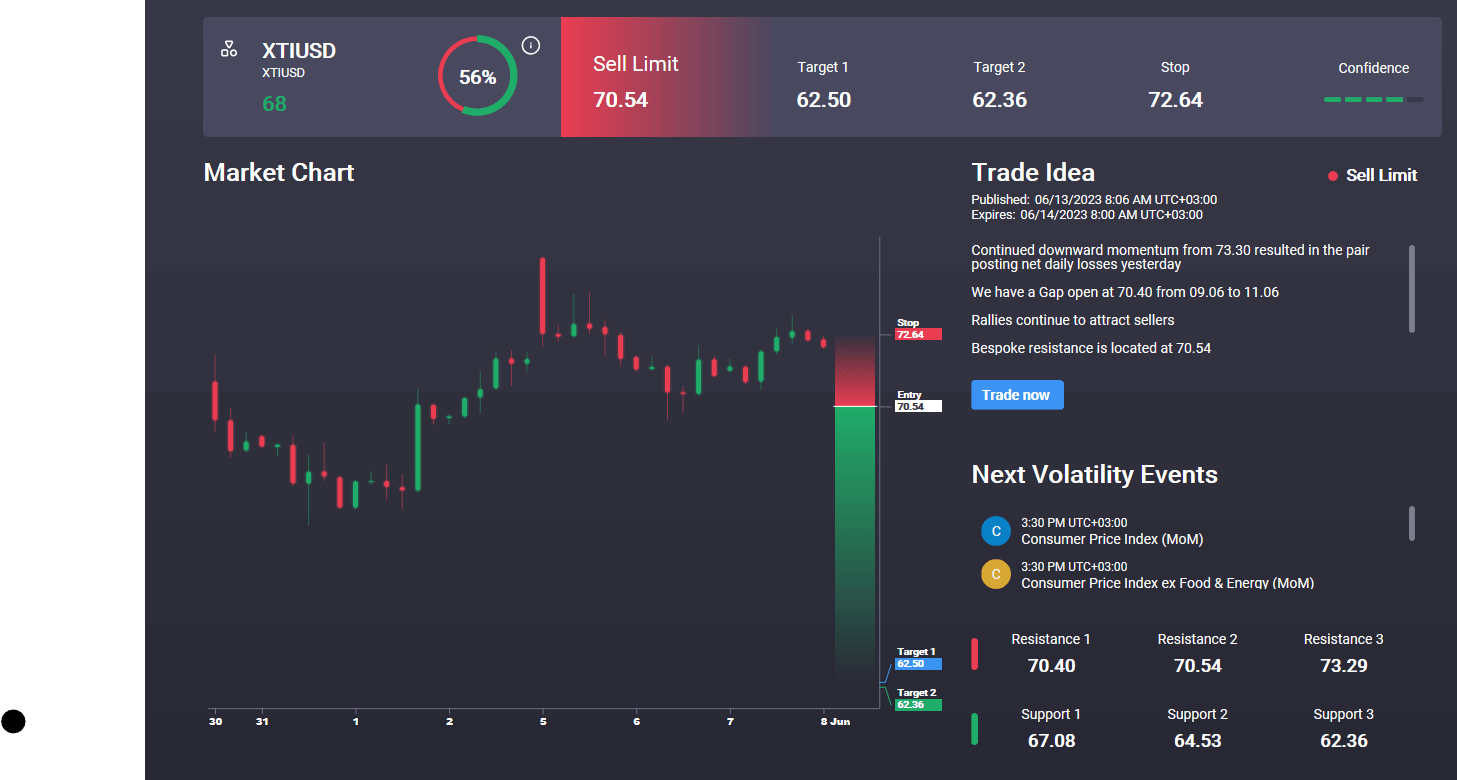

The reversal lower from around the bear channel highs has seen the market breaking back under the 72.61 level. Price has now traded back down towards the YTD lows, currently sitting just above the 65.34 level. With momentum studies turned bearish the focus is on a further break near-term unless bulls get back above the 72.61 level. Interestingly, we currently have an active sell signal in the Signal Centre for crude set at 70.54 targeting a move down to 62.50 next.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.