Decade of QE: Can we Expect a Turning Point for S&P 500 in 2020?

How would you characterise the passing decade for Corporate America and Wall Street? From all the various labels I would choose “Decade of Cheap Credit” as the most accurate and characteristic description.

This term embraced both low interest rates and years of unconventional measures, such as QE and even tax cuts pushed by Donald Trump, which the US borrowed from future generations (remember the so-called Ricardian equivalence).

And the first-line winners from the cheap credit and all those stimulus tricks was…US corporate sector.

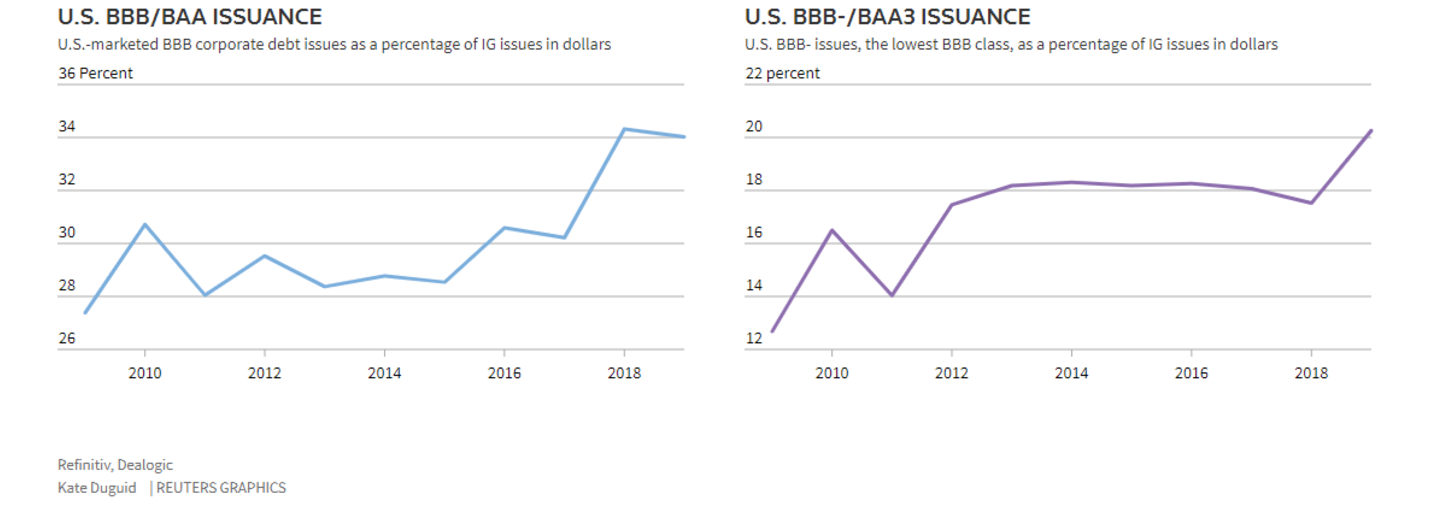

Firms in the US have been shining brightly in the corporate bond market thanks to low interest rates. Since 2010, they have been issuing debt at a stunning pace of $1 tn/year, calculated the agency SIFMA. In total it is more than $10 trillion in 10 years. Half-glass-full people will say the world became wealthier too (as the assets rose by the same $10 trillion) but obviously the fair value of these assets (or welfare of their holders) is tied to low rates which persistent presence led to slow shrinkage of assets that produce meaningful risk-adjusted return. For example, the share of the debt in investment-grade bond market, which rating is only slightly higher than “junk”, increased from a third to half, which indicates an increase in the overall risk level in the debt market.

But for the firms, increasing financial leverage should clearly have a goal: where those money were spent?

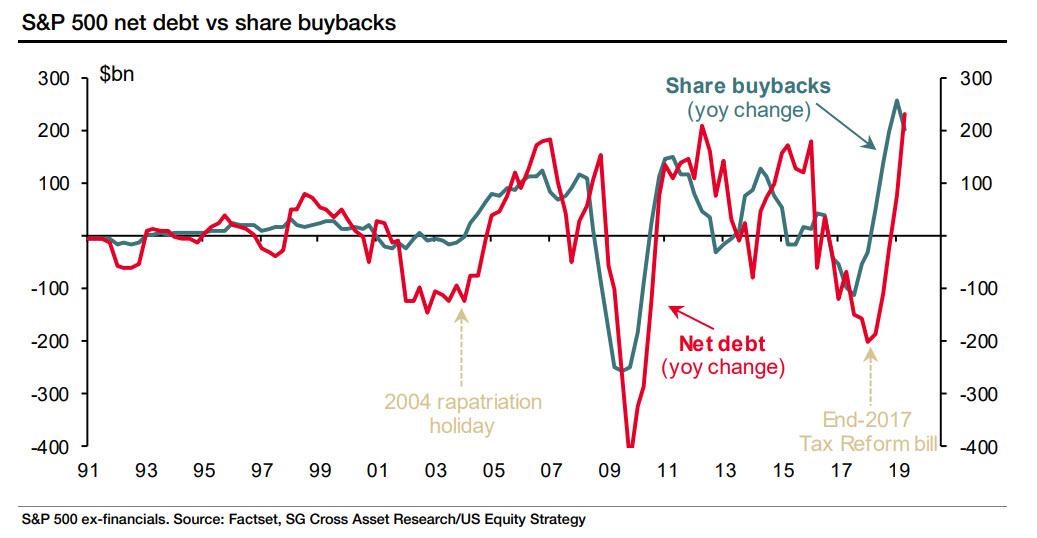

As we know the main goal of the management of a firm is to maximize welfare of the shareholders. The decision to use borrowed funds (or retained earnings) should also serve to the achievement of this goal. There are two alternatives - to spend money on the repurchase of shares/dividends or conduct potentially rewarding but risky investments in new projects. At the beginning of the decade the difference between stock repurchases and investments was only $60 billion, but by the end of the decade this gap widened to $600 billion. And with the onset of a trade war between the United States and China, the widening of this gap has accelerated.

Managers less often raise dividends, since it is not easy to cut them back. It is expensive (in terms of costs, correct communication of the decision) in contrast to the stock repurchase. Both managers and shareholders agreed that for a temporary cash surplus that has nowhere to spend, it is better to return it through stock buybacks.

Share buybacks were undoubtedly one of the main “booster module” in the S&P 500 rocket. The index grew by more than 184% over the past decade. The investor's favorite EPS metric has almost doubled, while company profits rose twice as less. Trump's fiscal reform, which led to the corporate tax reduced from 35% to 21% for the most part, only simplified and accelerated buybacks. In principle, this is not new:

The trend only suggests that the capital structure of companies (stocks + bonds) is becoming more vulnerable to the interest rate of the Fed (benchmark for the debt market) and less vulnerable to investor sentiment in the stock market by reducing the supply of stocks. It seems that the Fed policy will be become the main theme for the stock market in the new 2020.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.