Dollar Bouncing On Fed Chair News

USD Rebounding

The US Dollar continues to stabilise ahead of the weekend with the DXY bouncing back off the weekly lows printed on Tuesday. Much of the rebound appears linked to news that Trump will announce his new Fed chair nominee today, expected to be Kevin Warsh. Previously, Trump had been proposing Kevin Hassett who was a clear dove and expected to be easily influenced by Trump. Fears over the independence of the Fed had been a key factor in the bearish USD outlook this year. However, Warsh is seen as a more independent character and has a history of hawkish views, feeding into USD buying today.

Tensions & Tariffs

The bounce in USD is likely also a function of profit taking ahead of the weekend with traders booking profits on the sell-off, particularly given the precarious geopolitical backdrop and a fast-changing news environment. Tensions between the US and Iran remain high after Trump confirmed that he had sent another warship to the Middle East to join the naval assets which arrived last week. The US President also signed a fresh set of tariffs against countries supplying oil to Cuba while also threatening furtehr tariffs against Canada.

Technical Views

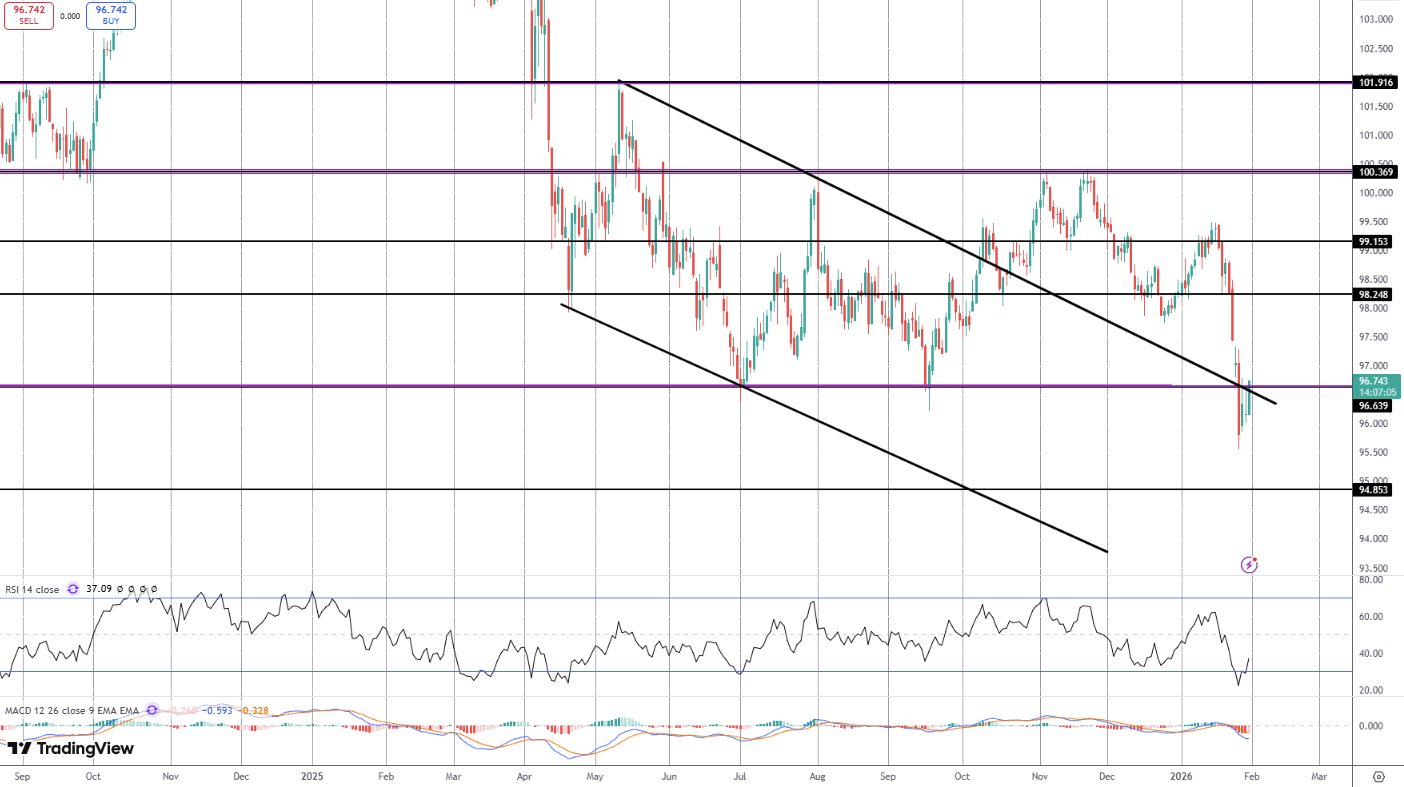

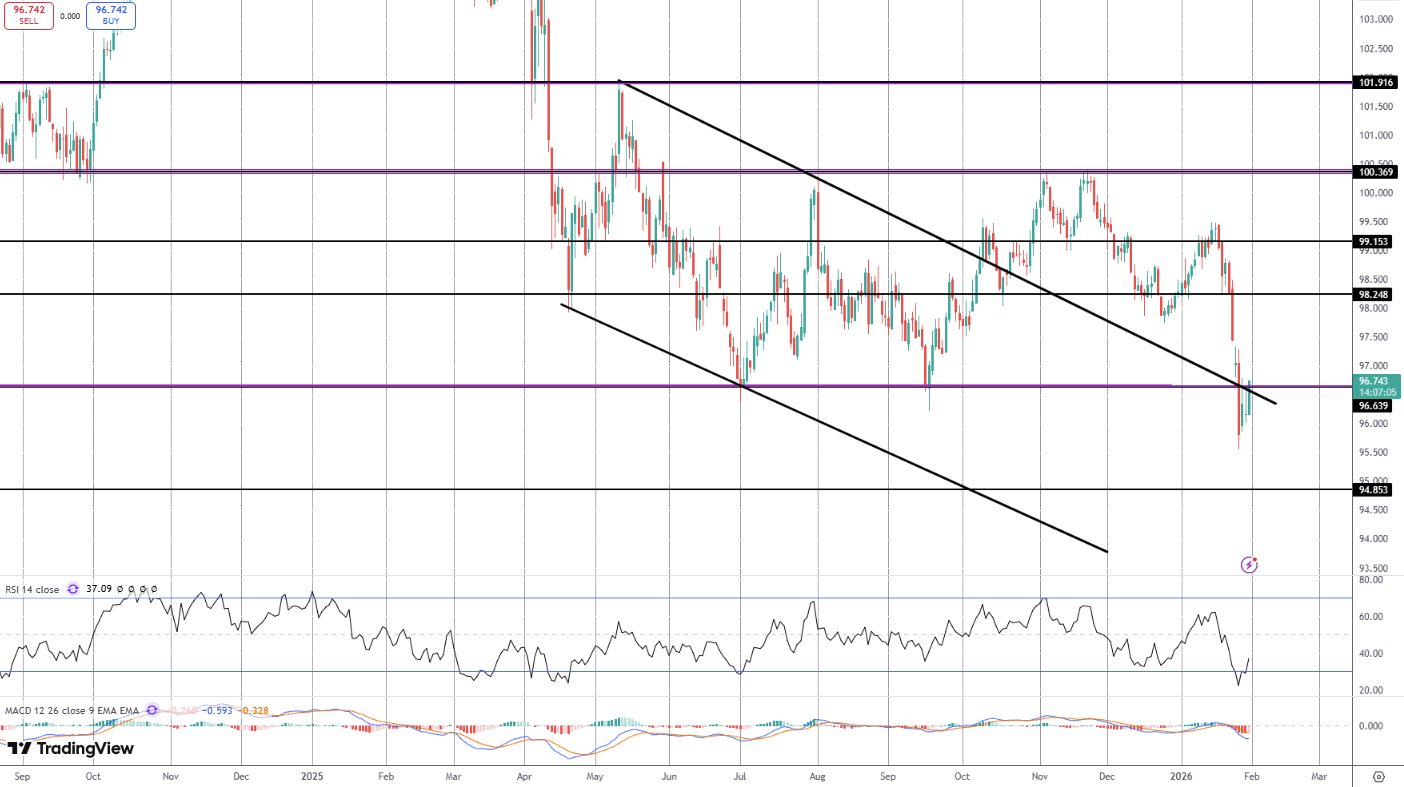

DXY

For now, the index remains below back inside the bear channel, capped by the 96.63-level resistance. While this area holds, focus is on a fresh downturn with 94.85 the next support to watch ahead of the bear channel lows. If bulls can break back above this resistance, 98.24 will be the next objective.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.