Dollar in December: Key Factors and Outlook

The dollar index has resumed its upward trajectory after just a three-day "breather" and a shallow correction from 107 to 106. However, the parabolic rise since early October (over 6%) to its highest level since last November raises justified concerns about the market being overbought. Such confident buying behavior near a multi-month peak suggests that the price is likely to attempt establishing a new high in the near future. Until Trump assumes office in the Oval Office, markets will be driven by rumors and speculations about how he will implement his "policy of coercion" in foreign trade. Rumors, as we know, are fertile ground for the continuation of trends whose irrationality can exceed all expectations. A telling example in this regard is the previous U.S. elections: with the arrival of the "blue wave" in American politics, the dollar steadily declined from early November until the end of December, depreciating by more than 5%, and began to reverse only in the new year:

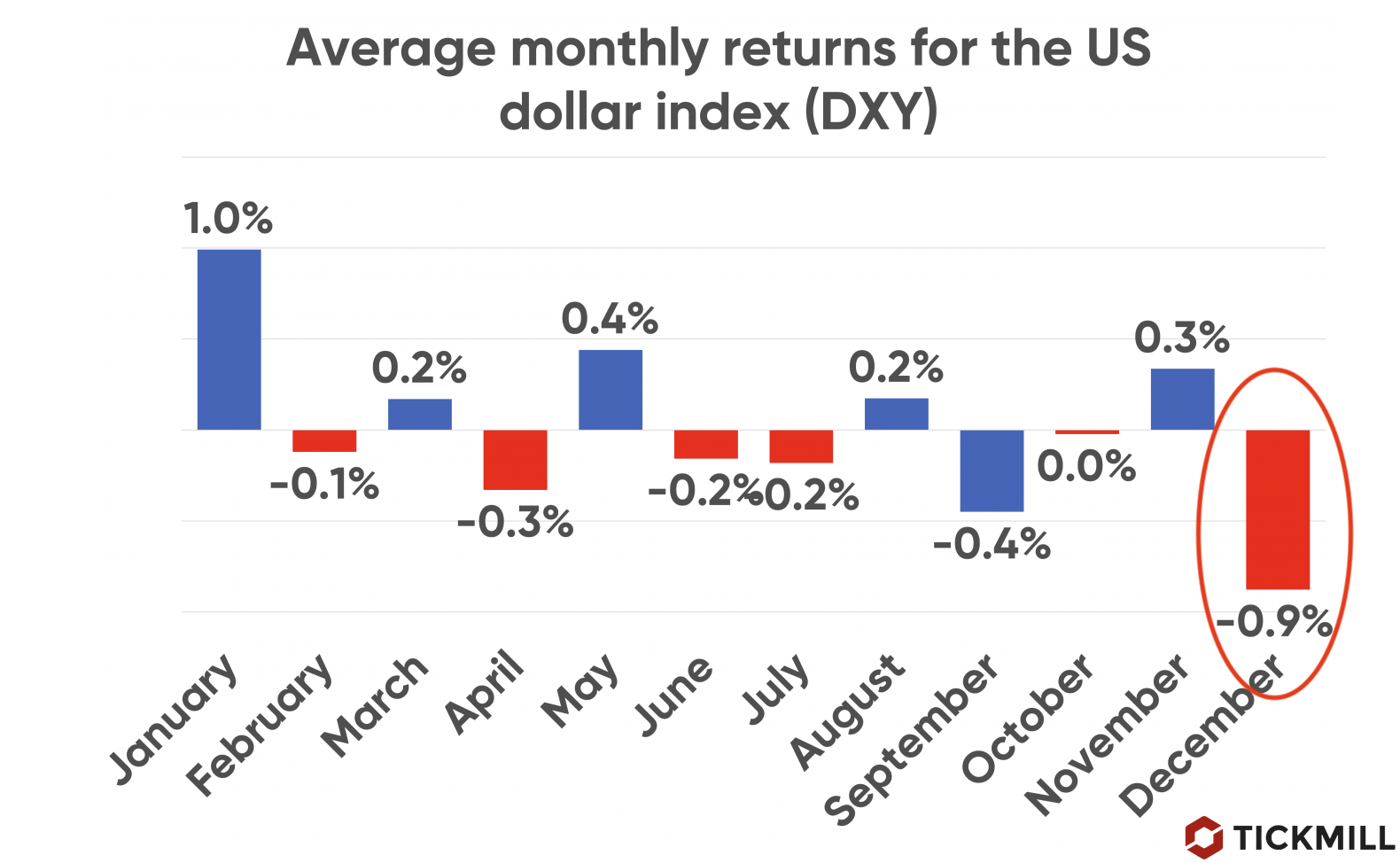

In contrast to the political factor, we can consider the seasonality of the dollar. Statistics since 1972 show that the U.S. currency faces the strongest downward pressure precisely in December:

This behavior of the dollar in December can be explained by several reasons. First, at the end of the year, institutional investors and fund managers conduct portfolio rebalancing (the so-called year-end rebalancing), during which they may increase sales of dollar-denominated assets, putting pressure on the currency. This is especially true for markets where the dollar serves as the funding currency for carry trades (AUD, NZD, ZAR, TRY). The second reason is a surge in consumer demand in December and, as a result, increased import volumes and, accordingly, a widening trade deficit, which is accompanied by an increased supply of dollars in the market. The third reason lies in the expectations of seasonal weakening themselves: attempting to account for the seasonality factor, investors engage in selling, thereby amplifying this effect. Essentially, it's a self-fulfilling prophecy.

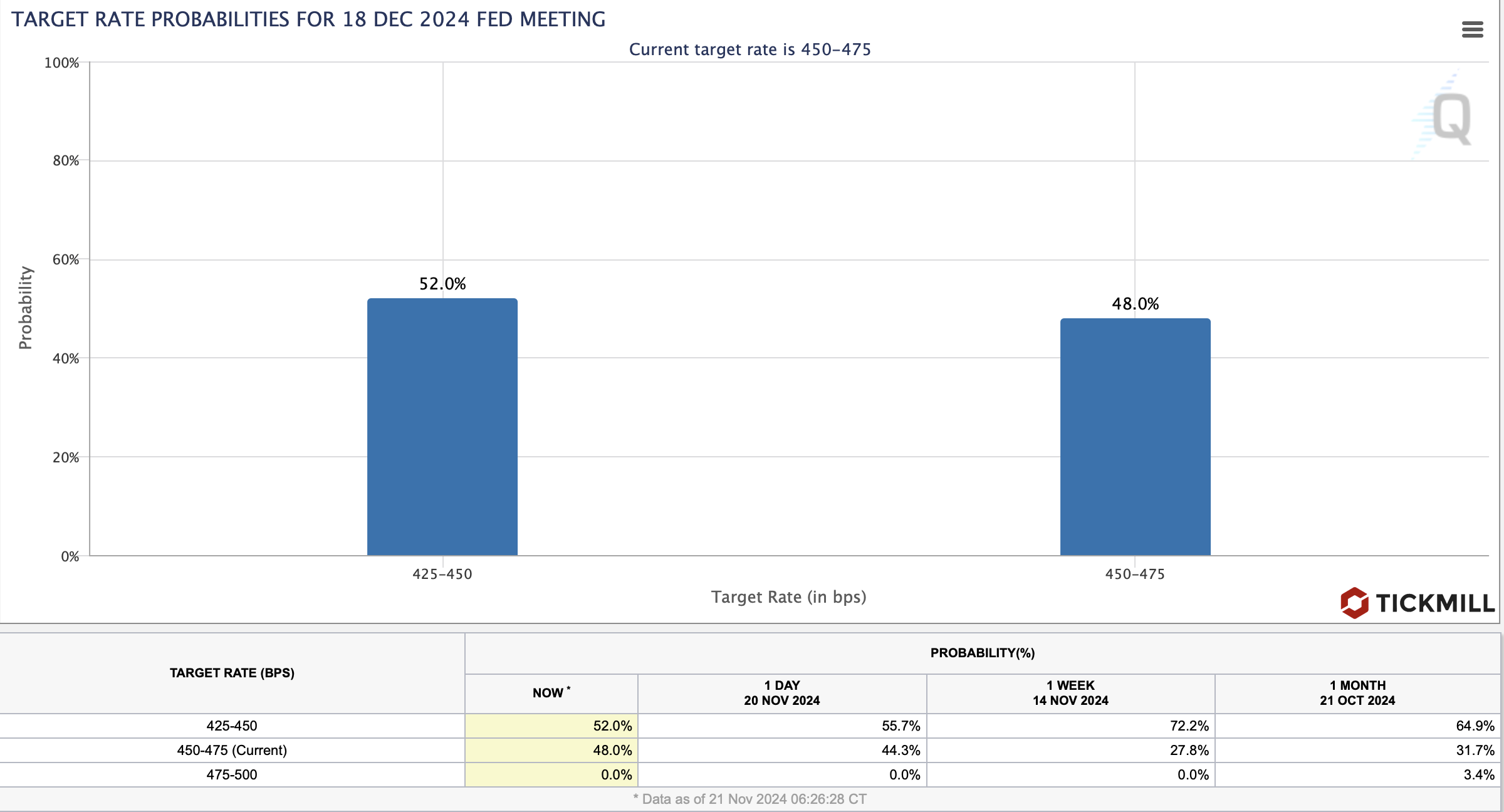

The potential for further dollar strengthening also lies in a possible additional re-evaluation of the chances of a December rate cut. The latest Reuters poll shows that an overwhelming majority of surveyed economists (94 out of 106) believe that the Fed will not abandon its plans to ease policy in December, even though market consensus has shifted in favor of the view that Trump's pro-inflationary economic agenda will slow the Fed down in this direction. However, the same survey showed that 57 out of 67 economists foresee a return to a high-inflation regime in the U.S. next year, which will extend the Fed's pause period regarding monetary policy easing. A series of key reports that will be released tomorrow and next Wednesday will help clarify the probabilities: these include the U.S. PMI indices from S&P Global, the consumer sentiment report from the University of Michigan, and Core PCE data. Interest rate futures are currently estimating the chances of a December rate cut at approximately 50/50, and the recent trend toward increasing the chances of a pause may continue if the upcoming reports indicate that the slowdown in the disinflation trend in the U.S. has not been fully priced in:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.