Downbeat Retail Sales Surprise Could Amplify Fed QT News, Extending Equity Correction

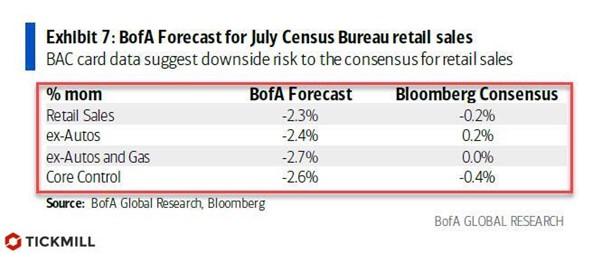

Global equities are down for the second day in a row while theUSD stands firm ahead of the US retail sales report release. Consumer optimismin the US dropped quite sharply in August, as indicated by data from U. ofMichigan on Friday. This laid the groundwork for downbeat surprises in USconsumption while the latest Bank of America’s estimate of retail sales in Julycalls for a closer look at the possibility of further correction of riskassets. With market consensus of -0.2% MoM, the US bank did not skimp onpessimism, estimating that the monthly decline in retail sales could be as muchas 2.3%:

At the same time, core retail sales, which more accurately reflect consumer optimism, may decline even more - by 2.7%. This is in line with the deterioration in consumer data from U. of Michigan.

One of the main reasons for a weak headline print may be a decline in car sales. Inflation data for July showed that price growth for used cars fell from 10% to 0.2% MoM. Therefore, the decline in sales in this sector is already largely priced in. However, markets will likely react on a surprising reading in core sales, i.e., retail sales which doesn’t include cars and fuel.

The risk of emerging slack of the key driver of economic pickup in the US - consumer boom, overlays expectations that the Fed this week and next will start to provide details on curtailment of monetary stimulus, in particular monthly bond purchases. Obviously, this will not be the right moment for this news as investors may start to price in a policy error from the Fed. In this case, we may observe an increased demand for long-term Treasuries, i.e., falling yields. So far, moderate sales of risk assets may be just an expression of these concerns.

Tomorrow, the minutes of the July Fed meeting are due, which will likely reveal some technical details on how the Fed can conduct QT and how long this process can take. Obviously, if these details appear in the data, it will be a hawkish signal for the markets, while weak economic statistics today are likely amplifying the negative market reaction to the Fed policy report tomorrow.The risk for equities especially US stocks are skewed towards further losses in the coming days as the data may reveal that the Fed picked wrong time for announcements regarding withdrawing monetary stimulus.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.