EURAUD Breakout In Sight?

-1699959965.png)

EUR On the Move

The Euro is pushing higher today and is doing particularly well on the crosses. A weaker USD is helping lift the single currency which is also being helped by some better-than-forecast data out of the eurozone today. While the first look at eurozone GDP for the last quarter was seen negative, in line with forecasts at -0.1%, stronger-than-forecast eurozone and German ZEW data helped boost sentiment. Both readings came in well above forecasts with the eurozone employment change reading coming in above forecasts also.

Repricing of Eurozone Outlook

Given how gloomy the eurozone outlook has grown over recent months, with a major focus on recession risks, the data is offering some hope and driving plenty of repricing. The ECB has warned over the downside risks facing the economy, feeding into a lower rates outlook from the market. However, with the caveat that further tightening might still be used if needed, today’s data shows that upside risks are still alive for EUR. Looking ahead today, if USD is seen falling further on the back of the October inflation report, this should help propel the Euro higher near-term.

Technical Views

EURAUD

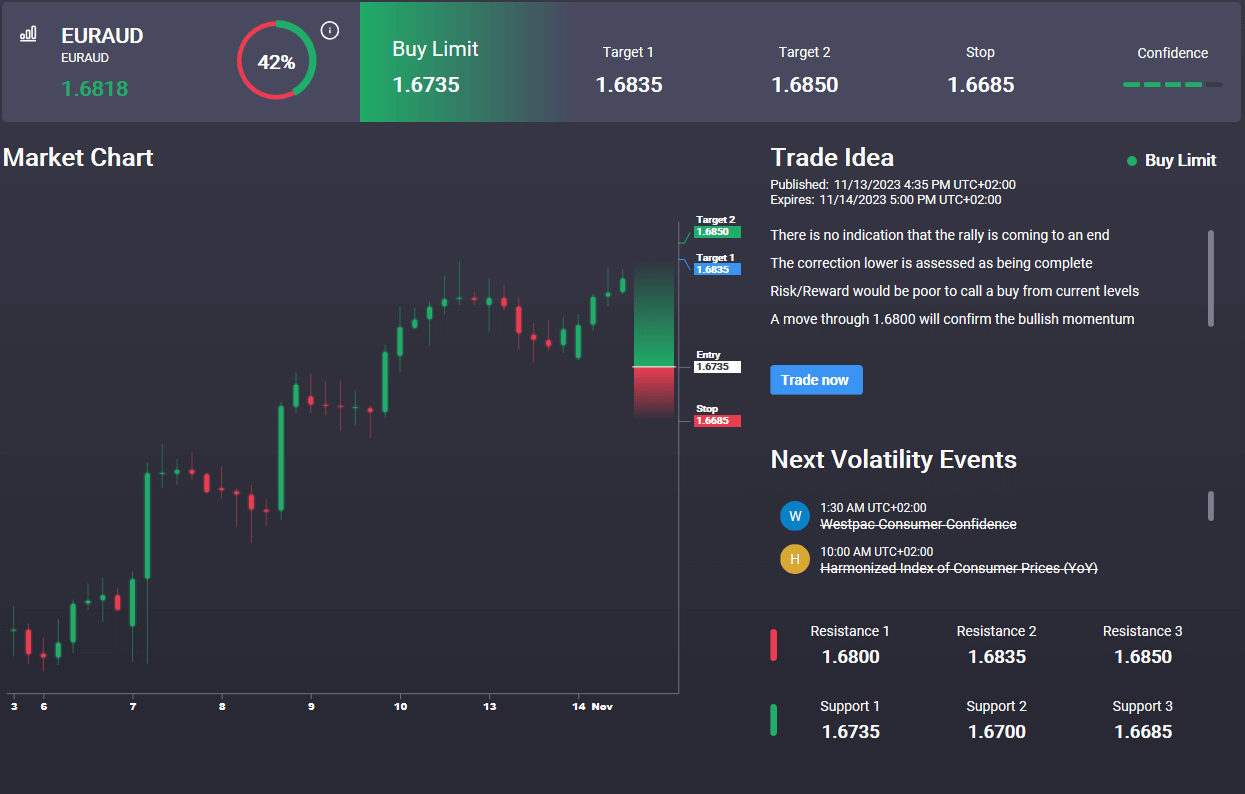

The break below the bull channel proved short-lived with the 1.6461 area holding as firm support. Price has since moved back into the bull channel and is now testing the 1.6829 level. This is a key pivot for the market and a break higher here will be firmly bullish, paving the way for a move up to 1.7071 next. Indeed, looking at the Signal Centre today, we have a buy signal set at 1.6735 suggesting a preference to buy dips.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.