EURUSD Falling As Traders Eye Fresh ECB Rate-Cut

ECB on Watch

EURUSD is in the red through early European trading on Monday as a stronger US Dollar takes its toll on the single currency. This week, traders will be focusing on the latest ECB meeting due on Thursday. The market is widely expecting the bank to cut by a further .25%. As such, the bigger focus will likely be on the quarterly update to inflation and economic forecasts. If the ECB is seen lowering its inflation outlook, this will be take as a sign that the bank is eyeing more aggressive easing over coming quarters, and should keep EUR pressured lower near-term. This will be particularly true if we see any uptick in US inflation on Wednesday, further boosting USD.

Eurozone Inflation Remains Lower

At its latest reading, eurozone inflation was seen falling to 3-year lows of 2.2%, further supporting the view that the ECB will press ahead with continued easing this month. The bank has been relatively guarded in its rate guidance, likely an attempt by the ECB to ward off any adverse price reactions that might feed into upward inflationary pressure. However, in light of the ongoing cooling of eurozone inflation, EUR might see a stronger move lower this week if the bank takes a more dovish view. Indeed, if inflation forecasts are revised lower and the bank strikes a more dovish tone in its outlook, EURUSD could see a sharp move down, particularly if US inflation fails to move lower again on Wednesday.

Technical Views

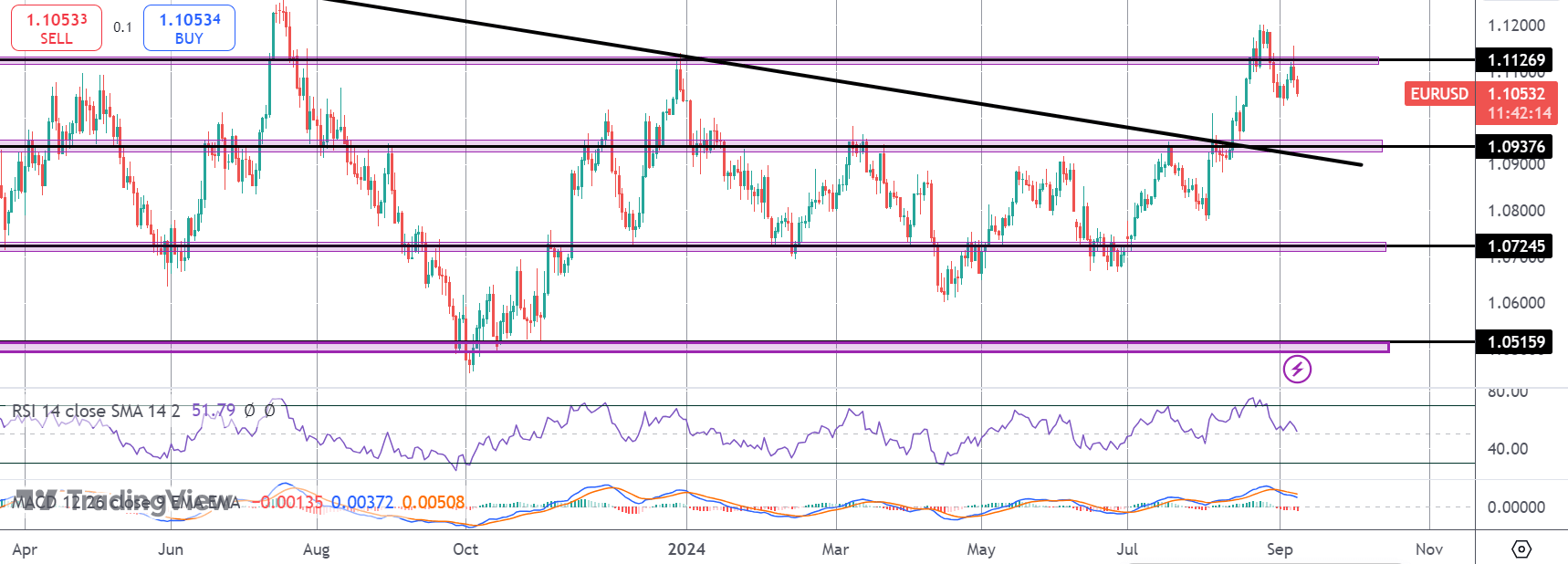

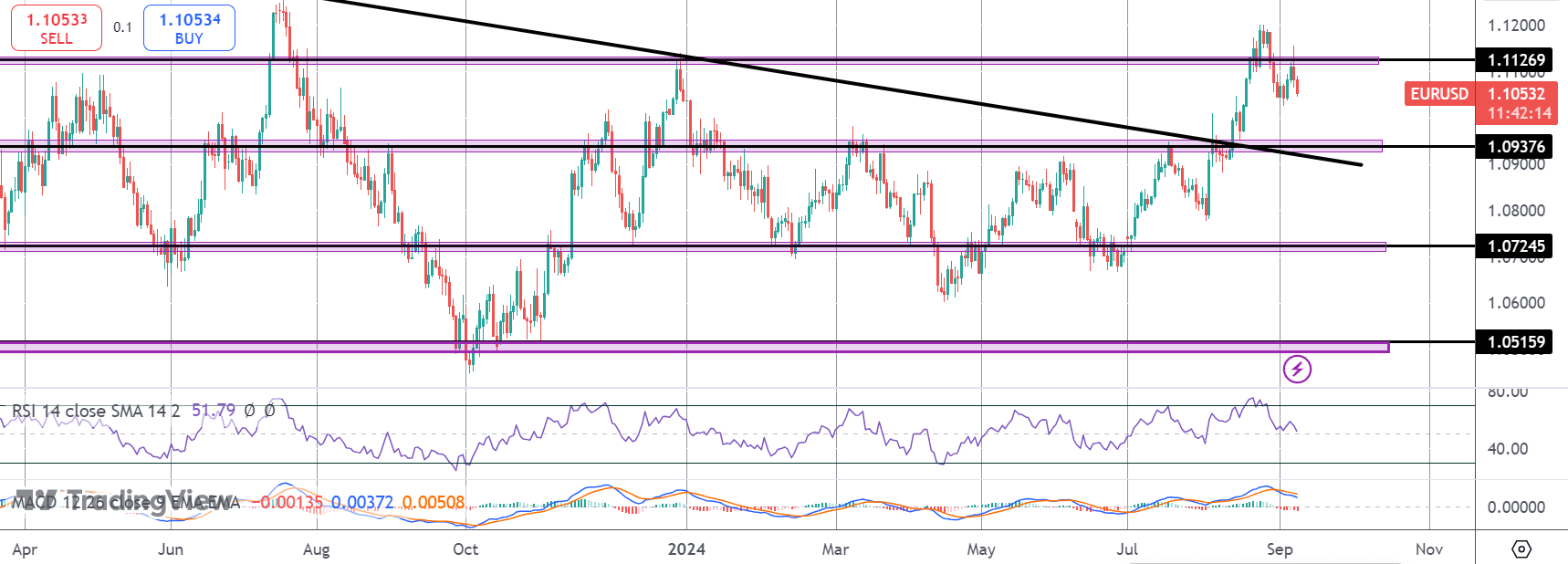

EURUSD

The rally in EURUSD has stalled for now into the 1.1126 level with the market now reversing below the level once again. With momentum studies softening, focus is on a continued pullback here with 1.0937 and the retest of the broken bear trend line the next support area to watch for bulls.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.