FTSE 100 FINISH LINE 15/12/25

FTSE 100 FINISH LINE 15/12/25

UK stocks saw a rise on Monday, with the FTSE 100 increasing by 0.9% and the FTSE 250 up 0.66% as analysts forecast a potential interest rate reduction by the Bank of England later in the week. The markets opened the week positively, having largely accounted for an expected rate cut. The FTSE 100 had risen by 0.9%, while the FTSE 250 climbed 0.8%. Both indices had ended the previous week lower for the second consecutive time. A Reuters survey indicated that analysts predict a tight 5-4 vote in favour of lowering the benchmark rate from 4.0% to 3.75%, which would mark the first decrease since August and set borrowing costs to their lowest in three years. Governor Andrew Bailey's decision is deemed crucial following recent data showing inflation dropping to 3.6% in October, with further declines expected. Markets believe that easing inflation strengthens the argument for a rate cut. While expectations surrounding rates have driven market sentiment, a rise in precious metals has further boosted the market. Precious metal miners saw a 1% increase, with gold prices remaining close to a seven-week peak and silver prices edging up due to a weaker dollar.

An index focused on personal goods, particularly luxury brands, surged by 2.3% after China revealed plans to enhance its exports and imports next year to promote "sustainable" trade. Burberry shares rose by 2.6%, and Watches of Switzerland Group gained 2.3%. Banks also performed strongly, rising by 1.3%, with Standard Chartered gaining 2.1% and Barclays 1.8%. The industrial metals and mining sectors were up 1.25%, with Glencore increasing by 1.3% and Antofagasta by 2.8%. However, individual stock movements included Hikma Pharmaceuticals, which dropped 1.4% to the bottom of the FTSE 100 after announcing that CEO Riad Mishlawi would be stepping down, with Executive Chairman and former CEO Said Darwazah taking over. Associated British Foods, the owner of Primark, fell by 1% after Jefferies downgraded its rating to "underperform" from "hold" and revised its target price down from 2000 pence to 1800 pence. Meanwhile, BAE Systems, the largest defence company in Britain, declined by 1% in line with the broader downturn in the European defence sector.

TECHNICAL & TRADE VIEW - FTSE100

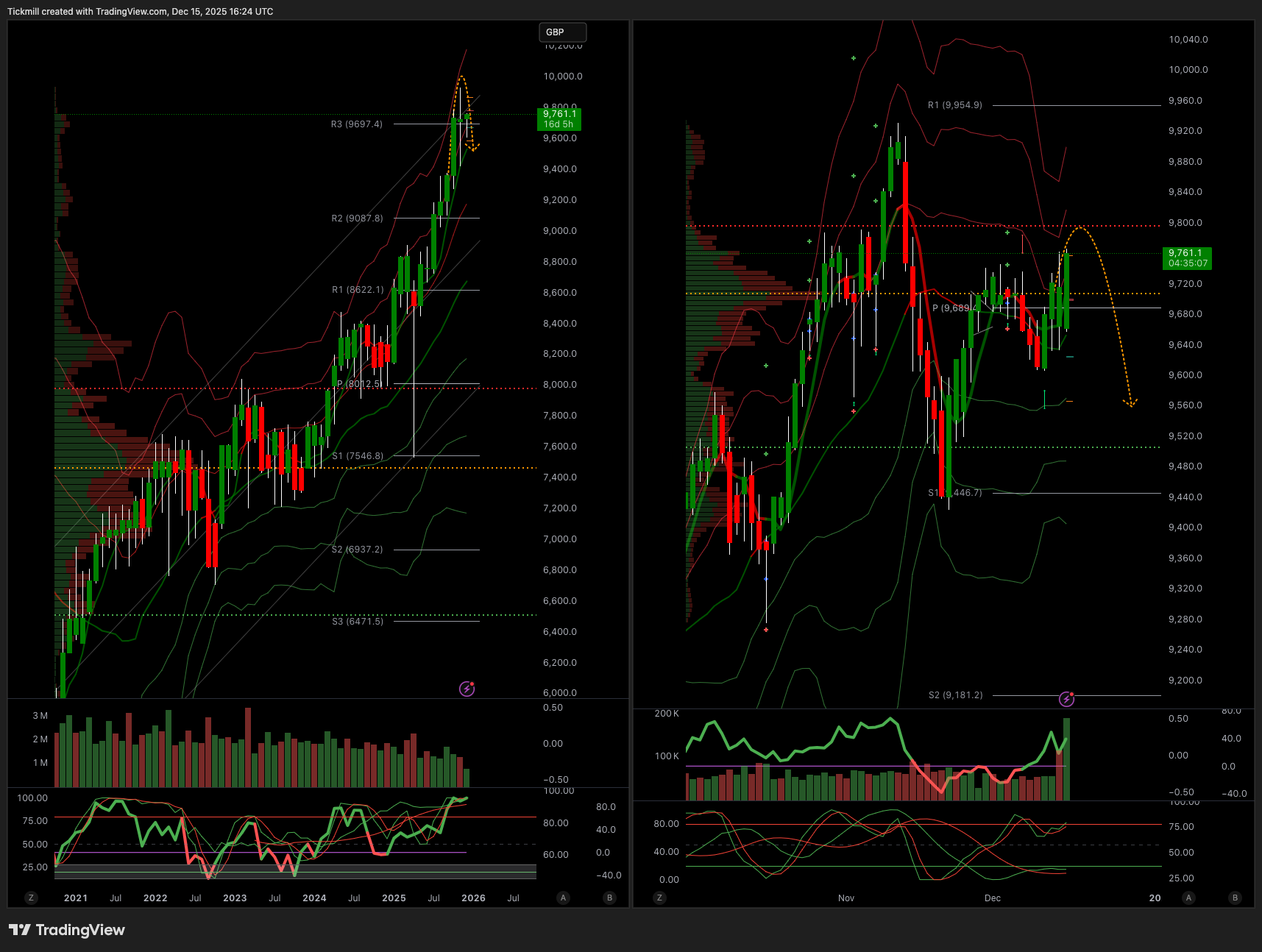

Daily VWAP Bullish

Weekly VWAP Bearish

Above 9720 Target 9800

Below 9700 Target 9550

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!