Helicopter Money – A new era of Stimulus?

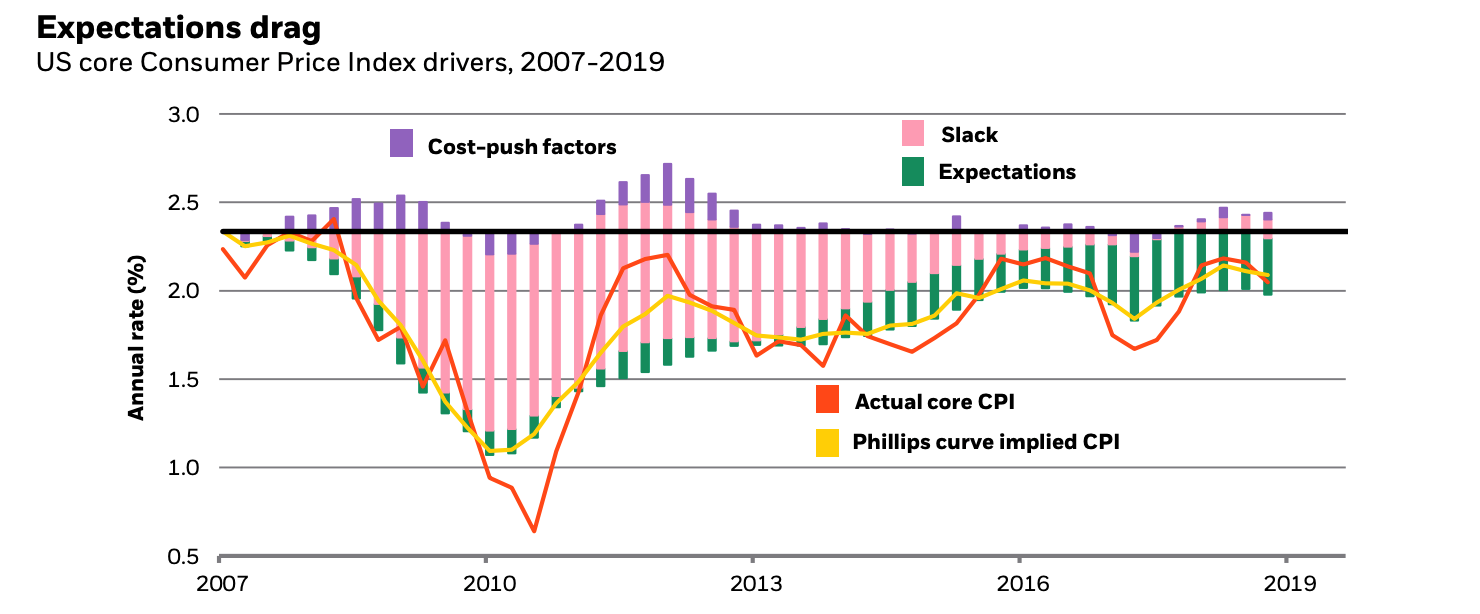

The “hunger” of the next recession for cheap credit will likely exceed the ability of central banks of developed markets to supply it. According to Black Rocks’ research, released in August, monetary authorities are rushing to tap potential of the monetary toolkit to contain the spread of negative expectations, hence missing the opportunity to replenish the ammo. This can be seen from the growing weight of expectations in the inflation formula, compared with post-crisis “slack” as the primary driver:

Current leg of credit easing is very unusual because it’s already started in the expansion phase, i.e. goes along solid economic fundamentals, like near-full employment in the US and consumer sentiments at record. The specter of a downturn appeared to be scary enough for Central Banks to start deploying their monetary tools.

Fiscal policy, in isolation from monetary policy, will also not be a panacea to cure next crisis, given the high level of debt and typical political hurdles to implement it. An effective solution can be policy coordination, i.e. monetary and fiscal policy acting together and enhancing each other which allows for a number of extreme measures, like “helicopter money” or, to put it simply, direct financing of the state debt by central banks.

Here are two reasons why application of monetary and fiscal policies separately won’t work during the next recession:

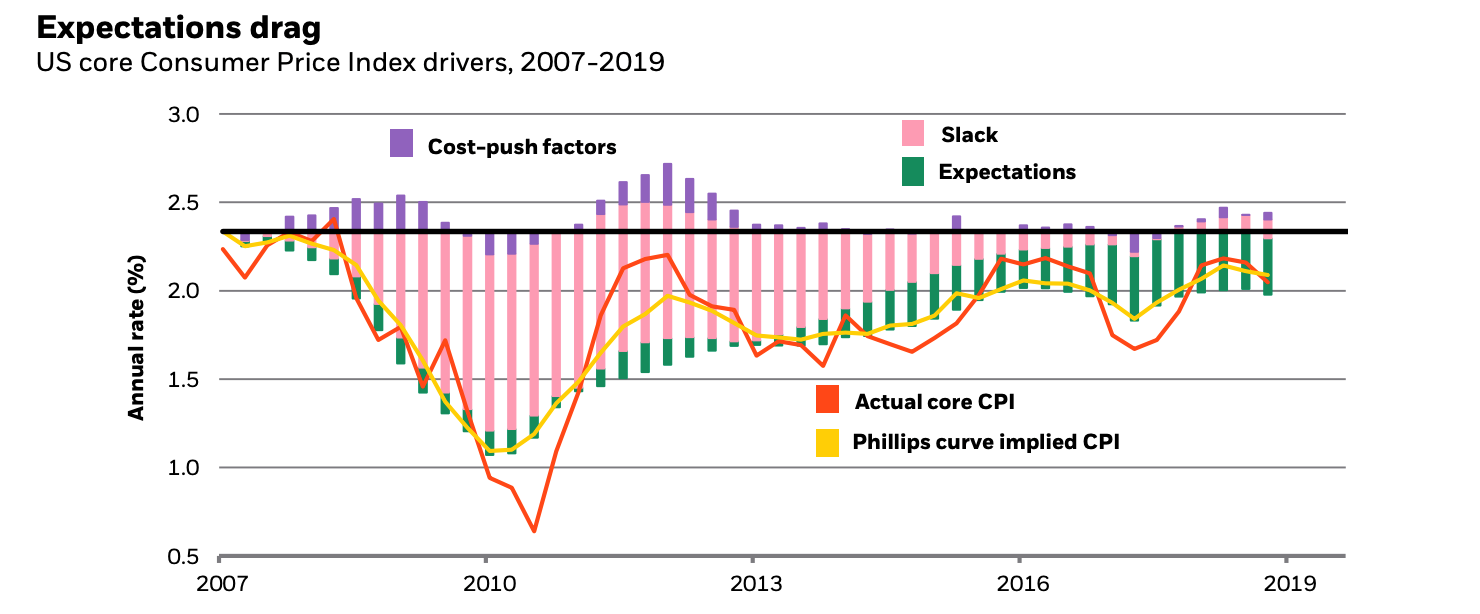

- An increase in risk aversion after a series of downturns (growing weight of safe assets in investment portfolios) and slowing potential GDP growth have been consistently reducing the so-called neutral rate. Simply put, this is an equilibrium interest rate at which two important macroeconomic variables – inflation and unemployment remain at desired levels. Declining neutral rate reduces the distance to an effective lower limit - a zero interest rate at which financial institutions would rather hoard cash than lend to each other. The next recession, comparable to the 2008 crisis, may require a reduction in rates of at least 2% and the potential for lowering rates will probably not be enough, pulling yield curves completely below 0%:

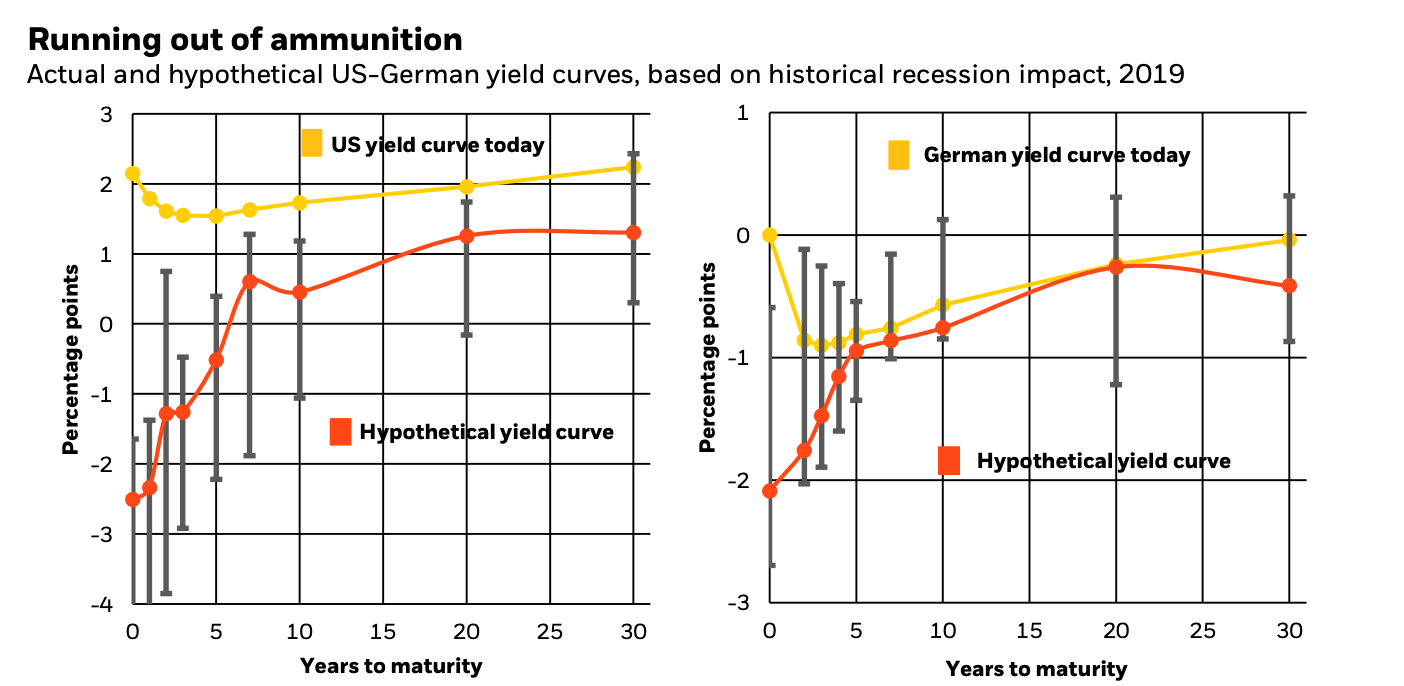

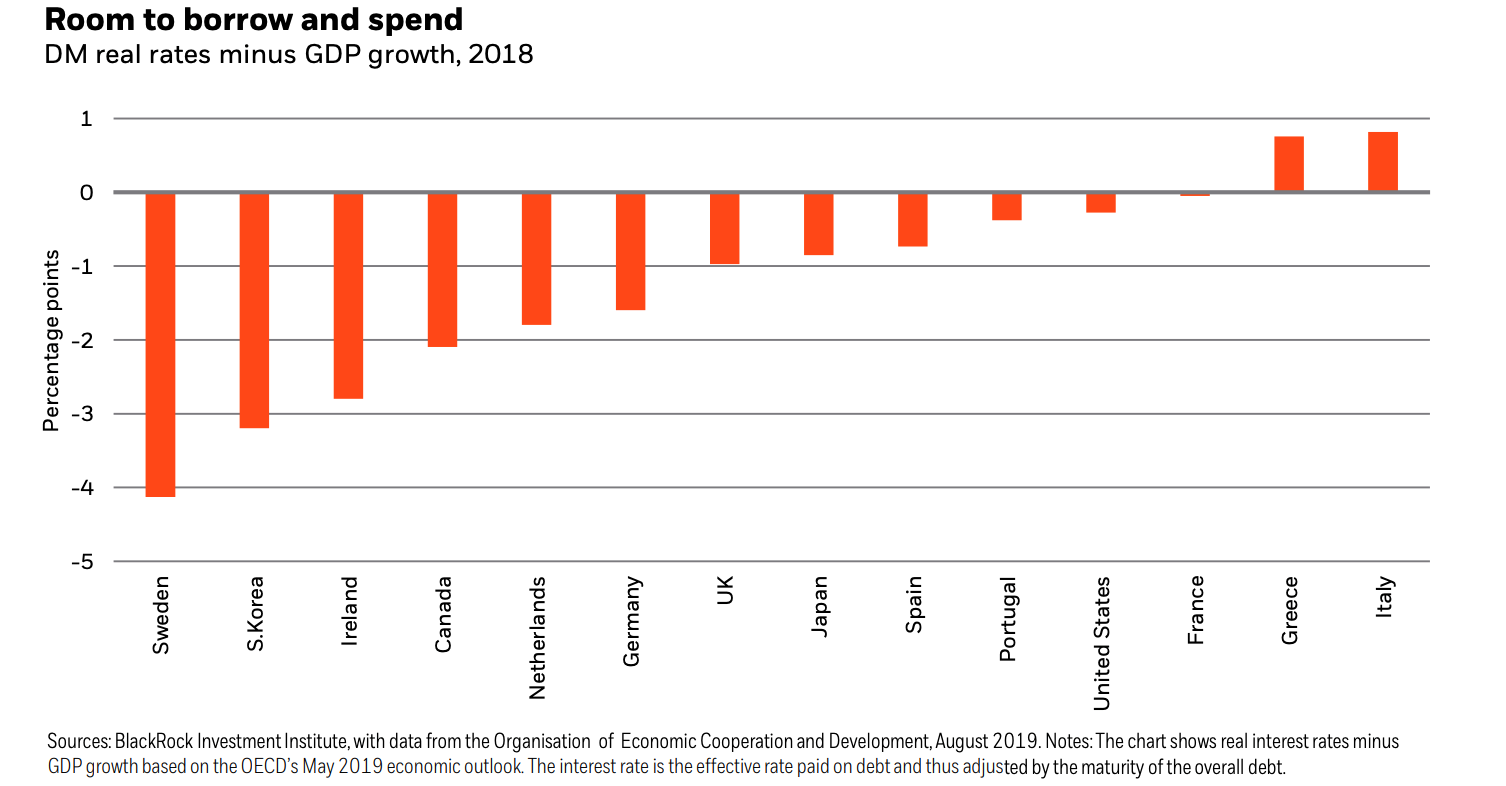

- An environment with stable low and negative interest rates creates a paradoxical opportunity for governments issue more debt, while reducing the ratio of debt servicing costs to government revenues. At the same time, the ratio of debt to GDP may even decrease (if risk-free rates remain below the cost of capital and GDP growth rates), allowing countries with high credit risk (Italy, Greece) to freely solve current short-term problems by issuing more debt:

But credit risk will surely emerge as soon as risk-free rates begin to steadily exceed the rate of GDP growth (i.e., during the next recession) and then fiscal stimulus will meet serious obstacles because of debt sustainability concerns.

So, what we get is potentially unlimited but not efficient monetary policy and efficient but limited fiscal policy. Can we combine them?

The answer is yes. This can be done by Central bank increasing its arsenal with fiscal instruments or directly ensuring debt sustainability of the government debt. As can be seen in both cases, this implies more opportunities for the central bank to directly influence consumer demand (buy goods or equities), bypassing the traditional transmission channel through interest rates.

In general, this approach is a prototype of a policy called the Modern Monetary Theory (MMT) which will be discussed further in the next article.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.