Institutional Insights: BofA Liquid Insight Case for a higher EUR/JPY

.jpeg)

Key insights

The increase in JPY appears to be less sustainable compared to EUR: 1) JPY positions are overextended; 2) JPY's varied performance in different market conditions; 3) The rise in EUR has been linked to a unique narrative; 4) decreasing expectations for Bank of Japan rate hikes amidst ongoing structural outflows. Keep an eye on US-Japan trade discussions as a significant driver.

JPY's rise appears more fragile than EUR's, despite both currencies gaining approximately 12% against the USD this year. Key differences include: 1) JPY's increase is linked to speculative positioning and potential US-Japan currency discussions; 2) EUR's rise has been more consistent across market conditions; 3) EUR is bolstered by Germany's fiscal expansion; 4) JPY's growth occurs amid reduced focus on Bank of Japan rate hikes and overlooked structural outflows from Japan. Progress in US-Japan talks could shift EUR/JPY upwards. Risks include a global slowdown affecting EU-JP yield spreads and potential US-Europe trade tensions. A "hard" currency deal between the US and Japan is unlikely.

JPY's rise appears less sustained than EUR's.

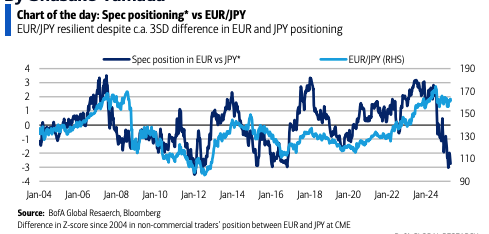

- Non-commercial traders hold a record long position in yen, with a notable difference in Z-scores between EUR and JPY since 2004 at -2.8. This unusual positioning hasn't resulted in significant EUR/JPY price movements. Market discussions suggest a focus on a potential US-Japan currency deal.

- EUR has shown more consistent growth this year compared to JPY across different market conditions. JPY's performance varies: rising during risk-off and Fed easing expectations, falling during risk-on, and showing little reaction to declines in US equities and bonds. EUR has strengthened in all scenarios, even when both US equities and Treasuries dropped, making it a potentially better USD alternative.

- EUR's rise is supported by positive news, such as German fiscal expansion, seen as transformative by our European team. In contrast, Japan's fiscal situation is weaker, limiting its potential as an alternative reserve currency.

- The market's focus on JPY has shifted from BoJ rate hikes to US trade policies. Our economists revised the next BoJ hike prediction from June 2025 to April 2026. Japan's structural outflows, a key theme for JPY, have faded from market attention, yet underlying flows remain stable amidst volatility.

EUR/JPY Outlook

Last month, we recommended purchasing a 1-year EUR/JPY call option (refer to: Liquid Insight: Flows and Trades for Japan’s New Fiscal Year, 25 March 2025). This strategy remains viable due to current positioning, the potential for a US-Japan agreement, and underlying factors influencing both currencies, such as Germany's fiscal expansion and Japan’s structural capital outflows.

Risks

Potential risks include a significant slowdown in the global economy, which could lead to a narrowing of EU-JP yield spreads and a halt or reversal in Japan’s capital outflows. Additionally, trade tensions between the US and Europe pose a concern. A less likely but possible risk is a bilateral "hard" currency agreement between the US and Japan.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!