Institutional Insights: Citadel - Global Market Intelligence

Citadel Global Market Intelligence (GMI) | August: FOMO Vibes

Scott Rubner

Key Takeaway:

My equity market framework remains unchanged. I am closely monitoring daily all-time highs while staying vigilant for a potential "blow-off" top driven by lagging stocks. The prevailing "pain trade" continues to push markets higher.

Market Dynamics:

July’s option expiration marked a critical technical event, with several trillion dollars in notional options expiring. According to Citadel Securities’ Institutional Index trading team, over 50% of the market’s long gamma expired on Friday, July 18th. This reduction in long gamma positions allows the stock market to move more freely, no longer tethered to the current spot level of 6300. Notably, the S&P 500 has maintained a streak of 19 consecutive trading sessions without moving more than 1% in either direction—a record for 2025.

Despite the relatively steady performance of the S&P index spot level this week, there was significant dispersion among individual stocks beneath the surface. This week, Citadel Securities observed notable retail trading activity in equities characterized by anti-momentum, elevated realized volatility, high market beta, and stocks heavily shorted by market consensus. Admittedly, some of these high-performing names were unexpected and certainly not on my radar. July seasonality remains a key driver of this equity market rally. Historical data spanning the past century shows the S&P typically consolidates around this time before trending higher toward the end of the month. This pattern aligns with seasonal factors such as vacation schedules, summer leisure activities, and a general reluctance to initiate new short positions during August.

Volatility:

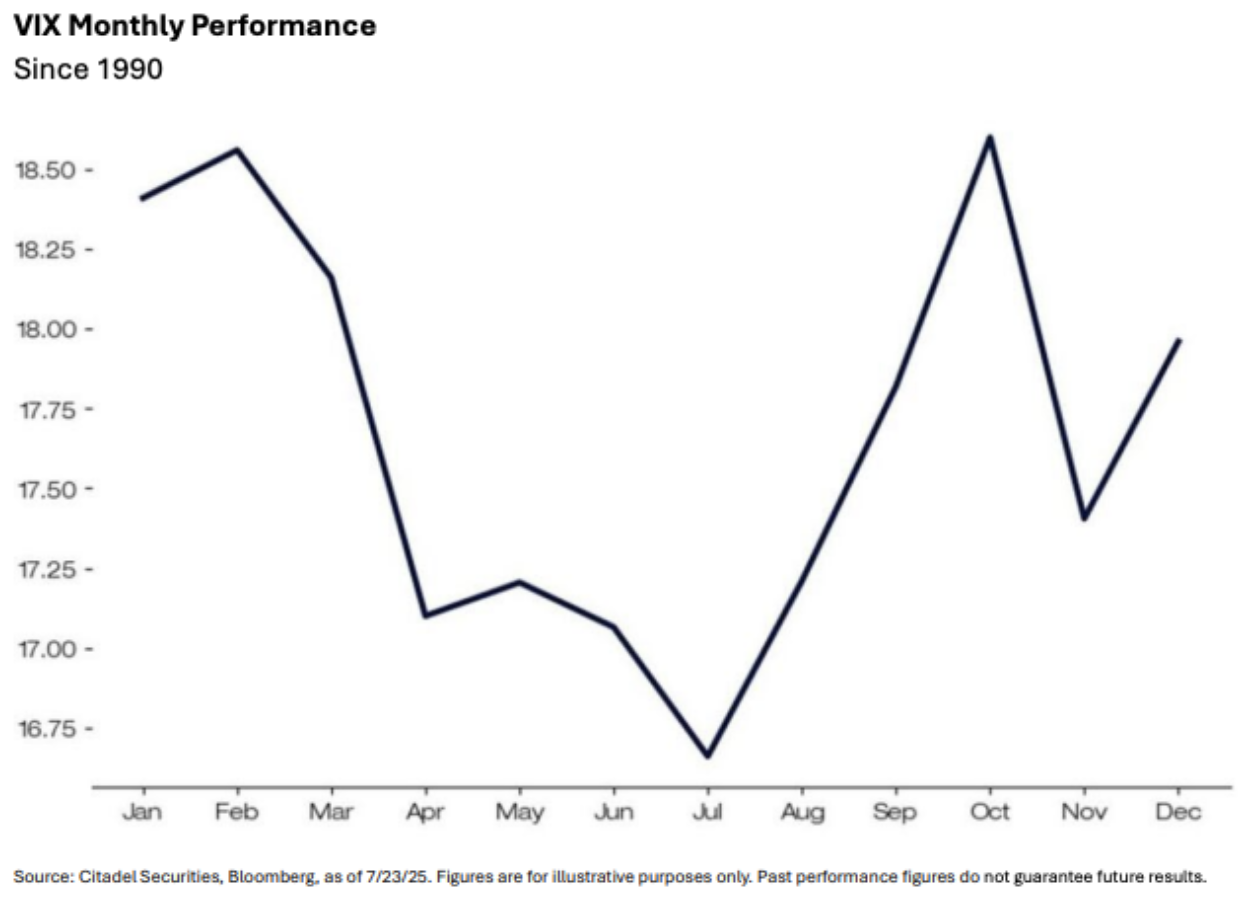

Volatility is likely to trend lower in July, with the VIX spot sitting at 16 this morning. Historically, July has often served as an inflection point for the VIX, frequently marking its lowest level of the year since 1990. Persistently lower volatility readings remain a key factor, as the ongoing decline in realized volatility may indicate sustained rules-based equity demand driven by non-fundamental factors

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!