Nomura Cross-Asset: THE HUMAN VVIX, OR "SWIMMING WITH PIGS"

The McElligott family’s spring break trip to the Bahamas coincided with “Liberation Day” last Wednesday, marking our departure from the U.S. and inadvertently shielding us from the market chaos that unfolded in the two days thereafter. In hindsight, the kids’ favorite activity during the trip—swimming with pigs on the beach—feels like an apt metaphor for the largest “risk-off” scramble since COVID, which decimated risk assets across equities (Asia and Europe were hit hard overnight), commodities, FX, credit, and crypto. Volatility surged, government bonds rallied in a massive “bull-steepening” move, and markets appeared to pressure central banks into rate cuts. At one point overnight, Fed Funds futures traded at 95.74, implying roughly a 30% chance of an emergency rate cut.

For U.S. traders who stayed up overnight watching the carnage in Asia and Europe, there was some relief as markets reversed course. Equities rebounded sharply from earlier lows, while U.S. Treasury yields fell from their highs, with the “belly receiving” trend finally cooling off. Instead of immediate escalation, the EU seems to be building countermeasures for a slower-burn approach, targeting the end of the month to negotiate from a stronger position. French and Italian authorities have signaled responses by the end of April, as noted by my colleague Marine Mazet. This strategy aims to buy time, particularly in digital and service sectors, to avoid further escalation.

Meanwhile, Bloomberg reports suggest that Chinese policymakers are considering measures to stabilize the economy and markets in response to U.S. tariffs. Over the weekend, top leadership and senior officials discussed accelerating stimulus plans to bolster consumption, including measures that were already planned prior to the tariff onslaught. While this news provided little immediate relief to Chinese equities overnight, it signals potential easing measures ahead.

Adding to this dynamic, light signaling from the Trump administration emerged later around 8:30 AM EST:

- Hassett: More than 50 countries negotiating on tariffs.

- Hassett: Time to ease off rhetoric a bit.

- Hassett: Some 'great' deals countries are bringing on tariffs.

As a result, markets have recovered significantly from the worst “risk-off” levels seen overnight. U.S. Treasuries are now lower on the session, S&P futures have bounced nearly +200 handles from their overnight low, and volatility has eased, with the VIX dropping 6 points from its earlier peak at 40. Notably, USD rates sales teams report continued foreign real money selling Treasuries across the curve, with the heaviest selling concentrated in the long end last night. This trend, coupled with de-grossing and monetization of receivers, has amplified the rates reversal.

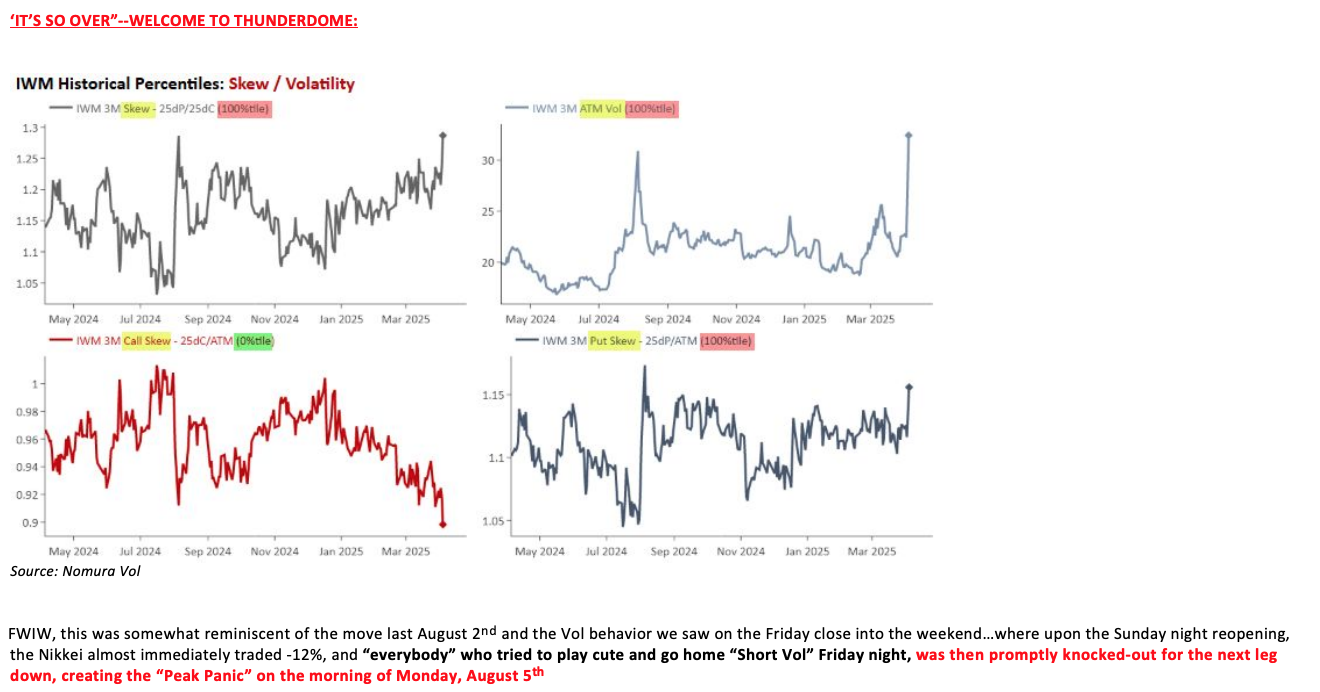

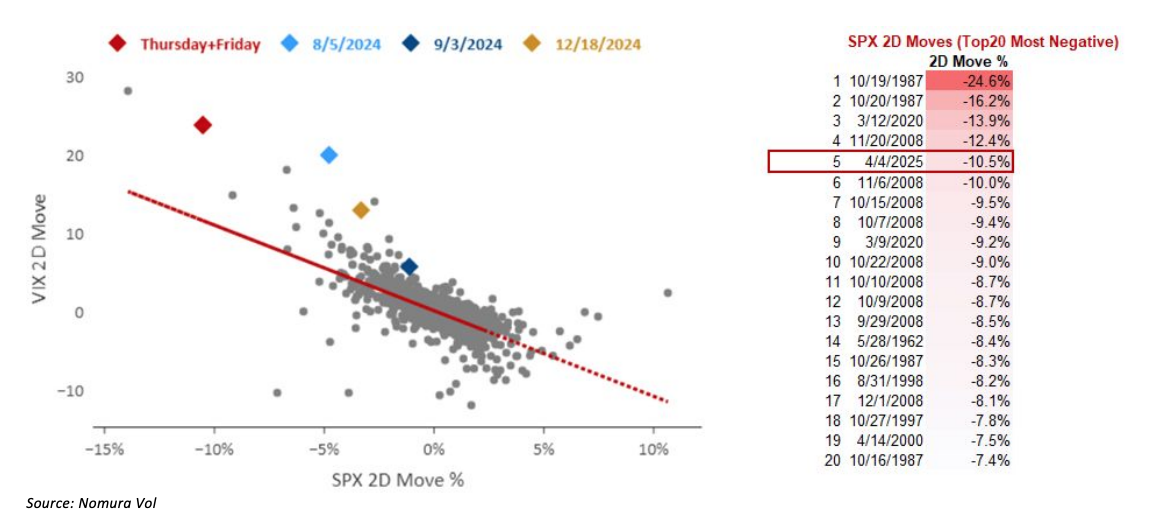

Despite these recoveries, the “recession delta” continues to build with each passing day as confidence and visibility remain under pressure. Last week’s dramatic two-day equities rout (-10.5% cumulative, the fifth-worst two-day move for the S&P 500 since 1960) has left troubling signals for this week’s trade. Implied volatility, skew, and the “volatility of volatility” closed Friday at absolute highs, indicating forced hedging, stop-ins, and reaching into deeper out-of-the-money tails. The path forward remains uncertain, with heightened risks and volatility dominating the landscape.

Similarly to last August's "Tail Shock," we once again witnessed the revaluation of "Vol of Vol" within Equities, resulting in a broader range of potential outcomes occurring simultaneously as the Rates market significantly adjusted the Fed's easing trajectory (and today, it's not solely the US—both the BoE and ECB are also incorporating anticipated cuts thus far today). The second-grade arithmetic effort to reduce Trade Deficits through Tariffs is acting like “sand in the gears” of Global Growth, exacerbating the risks of a hard-landing recession and/or a “Market accident.” Consequently, both Corporate executives and Consumers feel compelled to cut back on spending, which creates ripples throughout the economic ecosystem and eventually manifests in substantial Job losses, likely confirming the dire possibility of a recession.

This aligns with my recurring observation that POTUS Trump, as a “Gamma Shock Agent,” serves as the catalyst for “Volatility of Volatility” (Trump = “The Human VVIX”). His declared aim, or "mandate," is to disrupt the established norms of “Pax Americana” across policies and institutions, especially regarding sentiments related to Deficits, or rather Global Trade and the Economy. Essentially, he is reshaping the distribution of outcomes towards scenarios that the markets previously deemed unlikely, particularly at such a significant scale and on this short timeline. This implies unwinding years of historical positioning and leverage based on those previous “steady state” low Vol perceptions and assumptions, which translates to a retraction of both actual and effectively “Carry trades.”

Central banks around the globe are aggressively pricing in rate cuts as we speak, a pattern deeply ingrained in trader behavior over the past decades. However, markets are signaling concerns of “policy error,” as the perceived cautious stances currently being adopted by central bankers—due to inflation dynamics—risk triggering a deeper “growth shock” or even a “market accident.” Such events would likely compel even larger rate cuts in response, creating a cycle of reactive measures.

The key takeaway here is that any further resistance from central bankers to market pricing could exacerbate the situation, leading to more “tantrum” selling of risk assets, intensified bond buying, and more aggressive rate cut pricing. This vicious feedback loop could ultimately become self-fulfilling, amplifying market instability.

In the meantime, I’ve been asked two key questions: (1) Where could markets go from here? (2) What could Trump potentially do to alter or reverse the current trajectory of disaster?

Unfortunately, it seems plausible that U.S. equities could continue grinding lower by another 5%–10% per week until a significant policy adjustment or course correction is signaled. While corporate earnings season might offer a brief “micro calm,” reflecting a relatively solid period before the current wave of uncertainty, forward guidance is likely to be reduced—or even withdrawn—by many corporates. This would further weigh on sentiment. Additionally, legacy over-positioning in “U.S. exceptionalism” exposures accumulated over the past decade could lead to sporadic rallies driven by hedge monetization and dynamic short-covering. However, these rallies will likely only punctuate an overall downward trend, especially given the ongoing deleveraging by institutional players and recent capitulations from retail investors whose “buy-the-dip” mentality has been crushed by recent market conditions.

The concept of "policy change signaling" could resemble actions such as Ackman's tweet yesterday, which could potentially trigger a significant rally in risk assets. A sharp liquidation of U.S. equity longs, coupled with the negative wealth effect impacting consumer wallets and overall psychology, is likely to increase pressure on the Administration in the coming days to take action. Hypothetically, the President might announce ongoing negotiations with over 50 countries and propose a "goodwill pause" ahead of April 9th, which could spark a substantial risk rally—possibly even leading markets to go limit-up for a day or two.

Indicators suggest attempts are being made:

- HASSETT: Over 50 countries are negotiating on tariffs.

- HASSETT: Time to ease off on rhetoric slightly.

- HASSETT: Some countries are bringing forward "great" deals on tariffs.

However, at this early stage, with Administration officials (including Trump, Bessent, Lutnick, etc.) emphasizing a single-minded focus on tariffs as a necessary long-term strategy to achieve "pain for gain," the likelihood of immediate policy signaling remains extremely low. The Administration appears unconcerned about markets declining further, viewing this as a step toward addressing wealth inequality and shifting focus "from Wall Street to Main Street." This approach is simultaneously lowering long-term rates. A potential policy shift may only emerge after several additional weeks of ~10% weekly equity losses, which could weaken consumer confidence and disrupt the economy.

In the interim, Navarro remains as hawkish as ever, receiving high-profile visibility with appearances such as his CNBC "rush hour" primetime segment to reiterate the Administration's stance. Key points from Navarro include:

- Highlighting "non-tariff barriers."

- Suggesting that tariff reductions alone may not be enough to sway Trump.

- Addressing issues like currency manipulation, government subsidies, intellectual property concerns, and other non-tariff challenges, with claims that "other countries are cheating."

Turning to equity volatility, the latest overnight gap lower to start the week has pushed SPX deeper into territory that poses risks for index options players. Market makers and some customer-side flows, such as a large seller exposed to hundreds of thousands of SPX put spreads (4750-4800 / 4700-4750 / 4650-4700 / 4600-4650) set to expire in the coming weeks, could face underwater positions. Additionally, structured notes and exotics are at risk as spot equities continue their descent. With popular products nearing -20% to -25% knock-in barriers (and deeper barriers ranging from -30% to -40%), breached barriers could force dealers into short volatility positions, requiring them to buy back Vega at higher levels to maintain hedges.

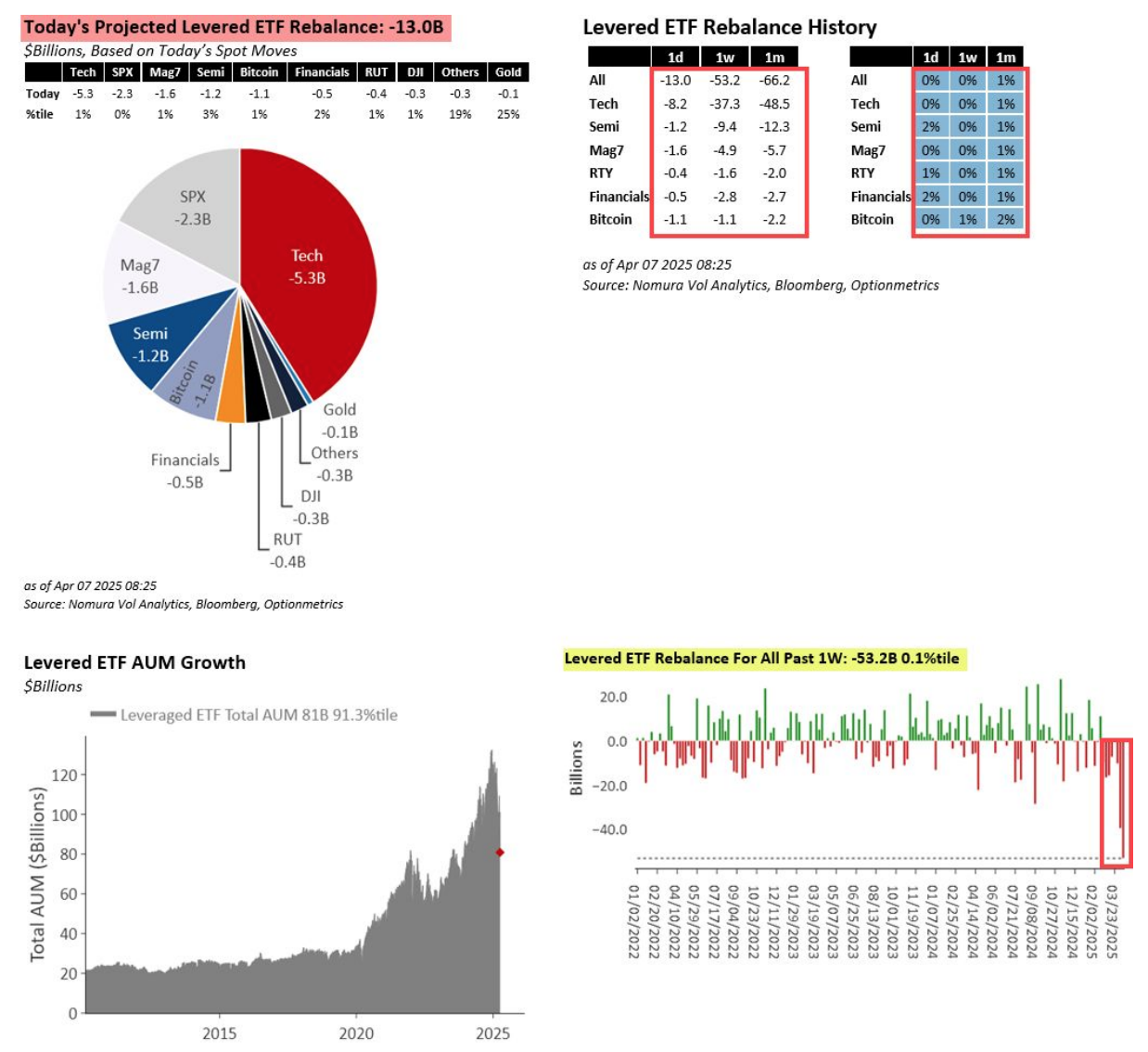

Finally, today's pre-market implied leveraged ETF rebalancing needs suggest more uneven flows for sale, despite the significant bounce off the worst levels seen recently.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!

.jpeg)