Loonie Rising Ahead of CAD CPI Tomorrow

CAD CPI in Focus

USDCAD is moving higher today ahead of tomorrow’s Canadian CPI release. The market is expecting CAD CPI to have slipped further last month. M/M CPI is pegged at -0.3%, down from the prior month’s -0.1% while annually, median CPI, is forecast to hold steady at 3.4%. However, given the M/M expectations, there is room for downside surprise, particularly given the weakness we’ve seen in oil prices recently.

Fed Impact

Should CAD CPI undershoot forecasts tomorrow, there is plenty of room for USDCAD to push higher near-term. While market forecasts are currently leaning towards a March rate cut from the Fed, there is room for this view to change should US data remain buoyant near-term. In this scenario, USD should continue higher against a weaker CAD.

Weak Oil Weighing on CAD

Weak oil prices are also having a strong downward impact on CAD currently. Despite fresh unrest in the Middle East, reports of higher production in OPEC countries is offsetting the upside impact these events might otherwise have. News of further missile attacks in the Red Sea have seen several oil tankers diverting their routes, causing further delays to distribution channels. Meanwhile, protests in Libya continue to keep a key oilfield offline there. However, traders appear more focused on the current division in OPEC which looks likely to thwart any attempt by the Saudi leadership to drive prices higher.

Technical Views

USDCAD

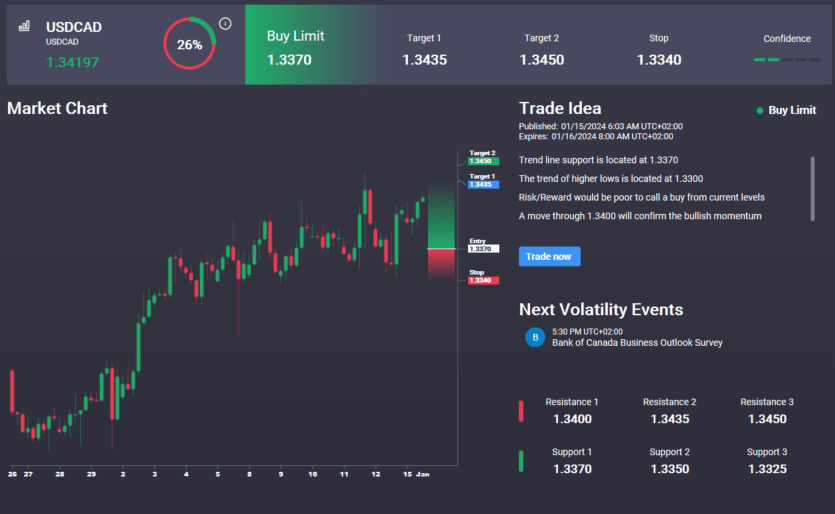

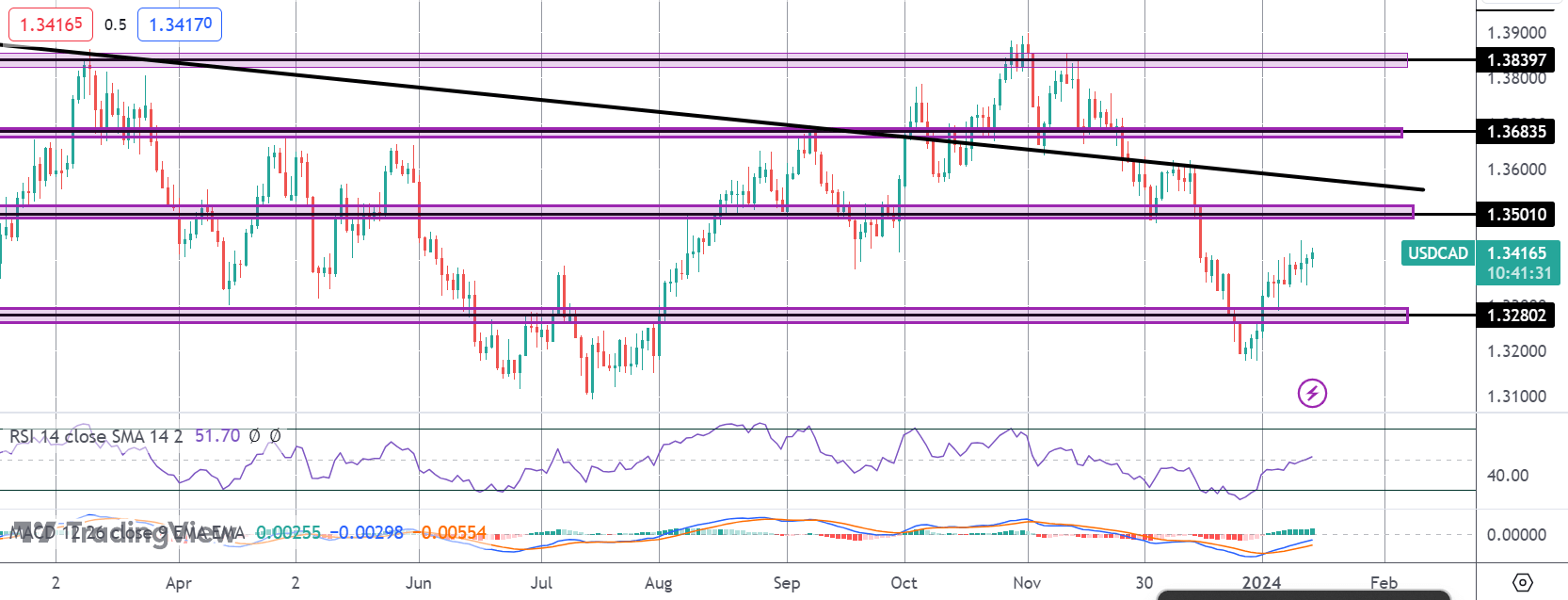

The rally in USDCAD has seen the market breaking back above the 1.3280 level. Price is now fast approaching a test of the 1.3501 resistance. With the bear trend line just above, this is a key area for the market with a break higher seen opening the way for a test of the 1.3683 level thereafter. Notably, we have an active buy signal in the Signal Centre today set below at 1.3370 suggesting a preference to buy any dips.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.