Market Spotlight: CHF Rallies As Inflation Spike Again

CPI Jumps in February

The Swiss Franc has had an explosive start to the week in response to the latest set of inflation numbers released today. Swiss CPI was seen rising 0.7% last month, up from the prior month’s 0.6% reading and well above the 0.5% reading the market was looking for. Core CPI saw a similar gain of 0.8%. In all, the data takes Swiss CPI up to fresh six-month highs, putting pressure on the SNB.

Hawkish SNB Expectations

Looking at the yearly reading, CPI was seen rising to 3.4% from 3.3% in January, despite forecasts for inflation to slow down to 2.9%. Core CPI was firm again also, rising to 2.4% from 2.2% prior. The yearly figure is now sitting just below the August 2022 peak of 3.5% and, as result, traders are once again looking to the SNB with the prospect of fresh action being discussed.

Resurgent inflation and hawkish central bank expectations have become a theme of recent weeks and with this data, the rally in CHF suggests the market is wary of further tightening at the upcoming March SNB meeting. Near-term, these expectations should also feed into better safe-haven demand for CHF over JPY keeping the currency supported.

Technical Views

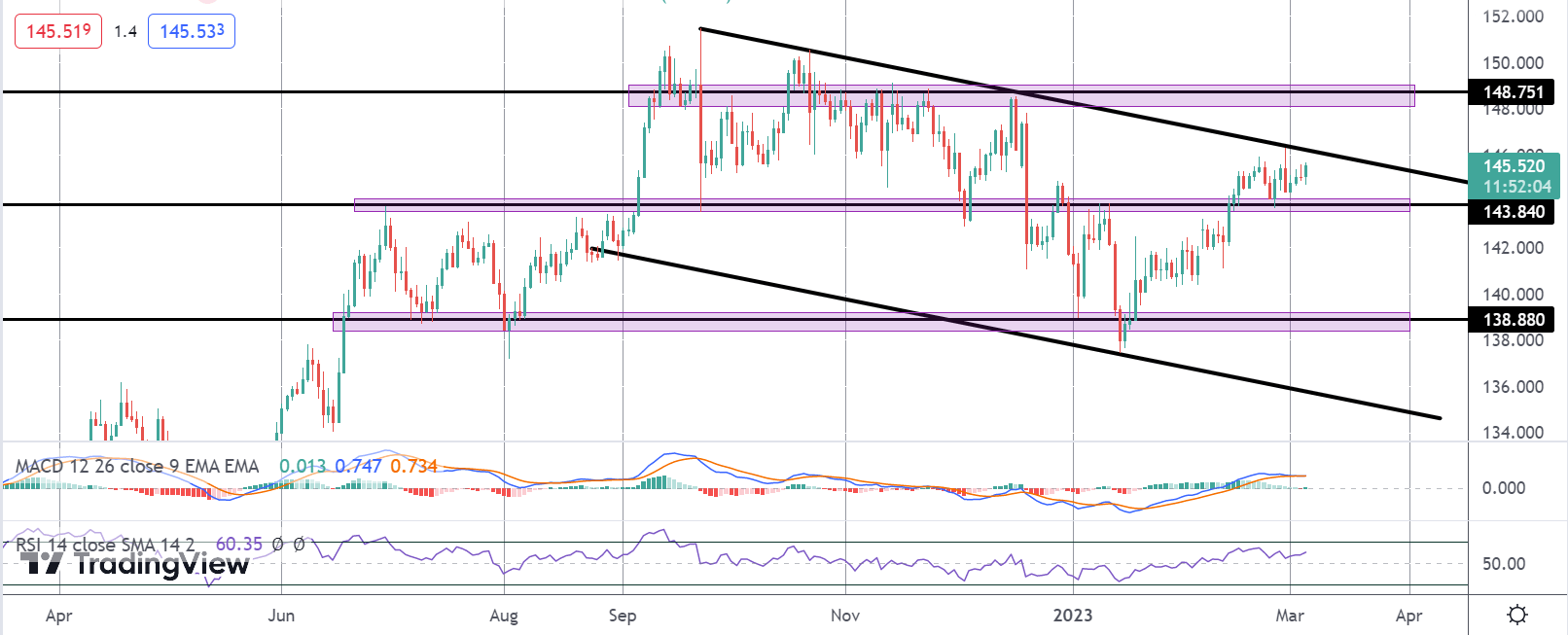

CHFJPY

The rebound off the channel lows and 138.80 support has seen the pair trading back above the 143.84 level, now testing the channel top. With momentum studies turned bullish, while price holds above 143.84, the focus is on an eventual break of the channel top and a test o the 148.75 level next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.