Market Spotlight: Nat Gas Volatility At Lows

Natural Gas Breaks Lows

The sell off in natural gas prices from the highs seen early last year has seen the market collapsing by almost 70%. Natural gas futures recently hit their lowest levels since late 2021 as a milder winter in Europe has allowed for far less demand than typically seen over this period. Given the record build up in European stockpiles ahead of recent months, the subsequent drop in buying has fuelled a rapid repricing in gas markets.

Europe LNG Imports in Focus

Most recently, however, we’re seeing some volatility around the lows as traders seek to reconcile lower prices with a need to maintain LNG imports. The drop in prices in Europe means that US producers are seeing better gains elsewhere, namely Asia. While stockpiles remain elevated this is sustainable. However, should the weather turn in Europe in coming months, any drop in LNG imports might well see a sudden rush of panic buying sending prices soaring again.

Maintaining LNG imports from the US is a key part of Europe’s strategic mission to replace lost Russian energy supply and as such there is a case for anticipating a floor in gas prices around current or slightly lower levels. One caveat to this is that the market still remains well supplied currently and, given expectations of a deeper downturn this year, the demand outlook remains muted for now.

US Dollar Impact

Another key factor to monitor here is the shift lower in USD. If this week’s US inflation data confirms the further anticipated cooling of inflation, this should see USD heading deeper, allowing for commodities prices to gain higher ground. As such, near-term prospects for natural gas look to be skewed to the upside unless we see an unexpected upside print in Thursday’s US CPI.

Technical Views

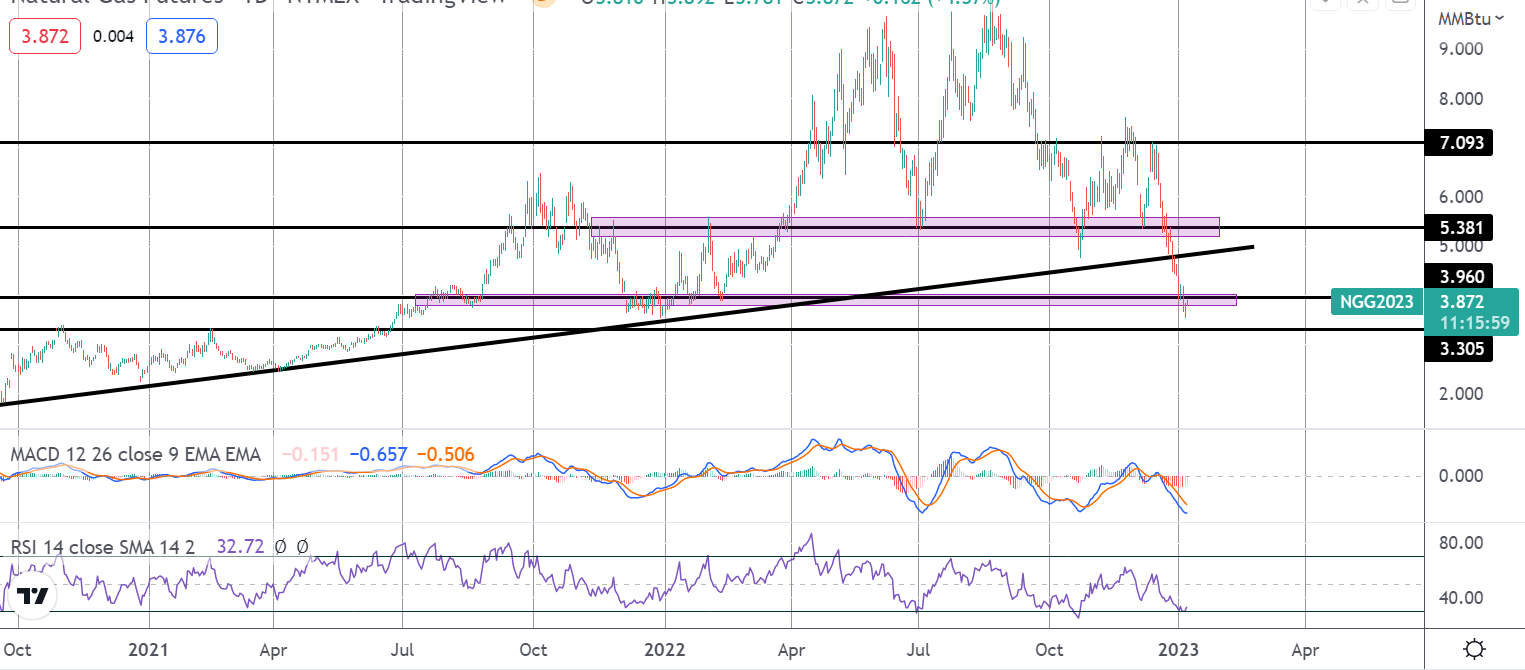

NG (Natural Gas Futures)

The key level for the market is the 3.960 in the near-term. Back above here, NG should find decent demand to carve out a base allowing for a retest of the broken bull trend line and the 5.381 level above. However, should price hold beneath 3.960, the focus remains on a further downward push towards the 3.305 level next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.