Precious Metals Monday 30-03-2020

Gold

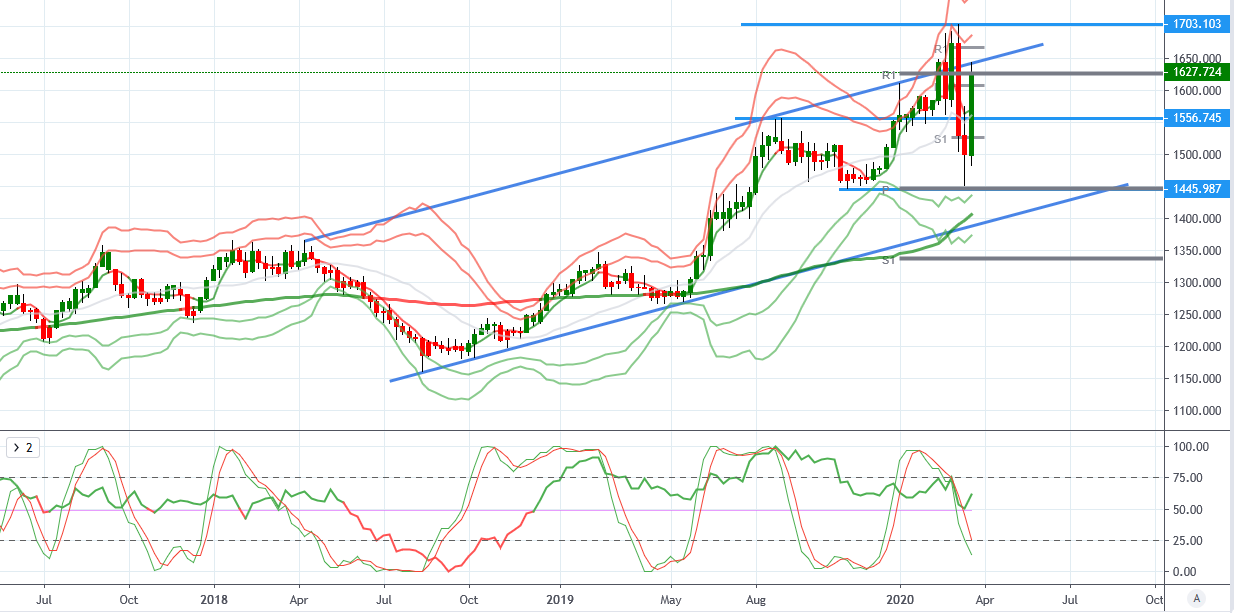

The gold market saw a dramatic recovery last week, with price rallying almost 11% on the week. Price has now recovered more than 13% off the 2020 lows. Last week marked a shift in investor sentiment as asset price began recovering in the wake of the latest central bank easing announced last week. The chief announcement came from the Federal Reserve in the US which announced that, following a series of rate cuts and the restarting of QE at $750 billion, it will now run QE as needed rather than to quota. This is an historic move for the Fed and appears to have helped stabilise markets for now.

The recovery in equities and commodities prices has helped underpin gold prices which are now rallying against a backdrop of subdued US rates and rate-path projections for 2020 as a result of the COVID-19 crisis.

The US employment reports on Friday will be closely watched by the market. Last week, US jobless claims soared above the 3 million mark casting serious shadows over the unemployment rate and NFP due on Friday. Very weak numbers in those readings could offer further support for gold.

Silver

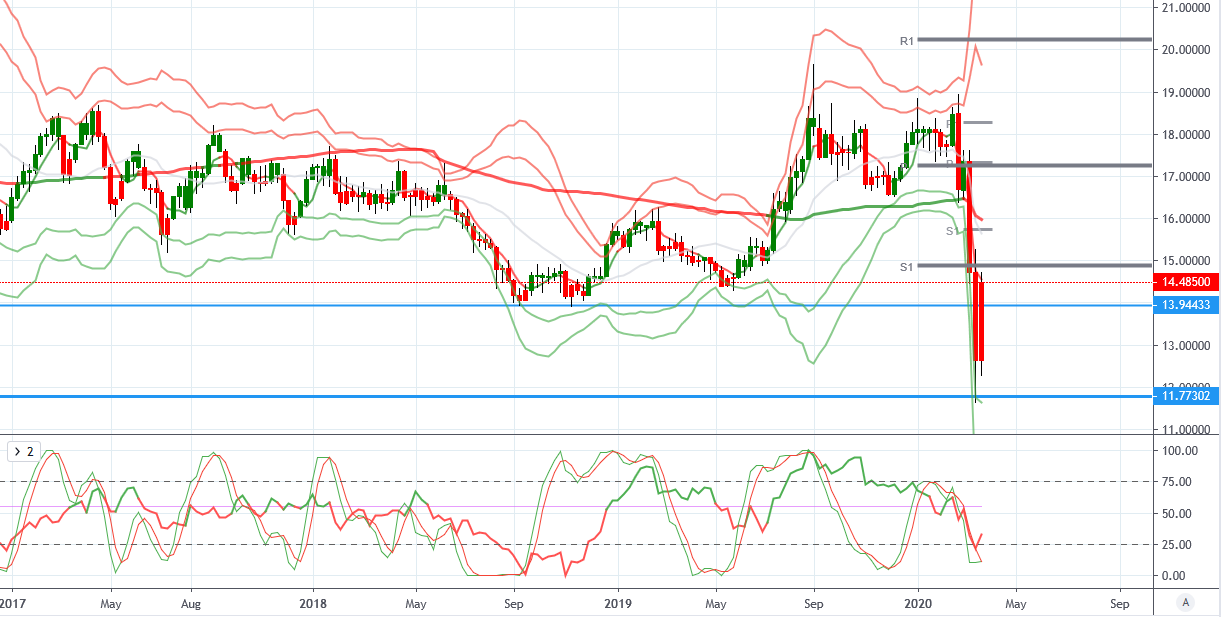

The silver market has seen moves similar to those in gold over recent sessions with price rallying off the 11.73 lows to trade back above the 2015 lows (13.9553). The recover in equities, especially industrial indices, has helped lift sentiment in silver. However, the silver market is not out of the woods yet and remains vulnerable to further downside shocks due to the ongoing lockdowns which threaten to keep economic activity subdued in the near term. Chinese manufacturing data this week will be closely watched by metals traders. With a great deal of silver’s demand linked to the industrial sector in China, further weakness here could see silver turning lower again.

Technical Views

Gold (Bullish above 1608.10)

From a technical viewpoint. Gold prices rallied strongly off the yearly pivot (1445.98) and are now once again testing the yearly R1 (1627.70). With VWAP still positive and with price holding above the monthly pivot again (1608.10) bias remains bullish with the 1703.10 YTD highs the first objective for bulls.

Silver (Bullish above 15.0000)

From a technical viewpoint. Silver prices have now recovered above the 2015 lows of 13.9443. If price can hold above here and move back above the yearly S1 at 15.0000 there is the potential for a broader recovery. However, with VWAP still negative and with price below both the monthly and yearly pivot, further downside is still a risk.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!