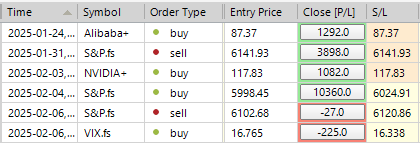

SP500 LDN TRADING UPDATE 7/02/25

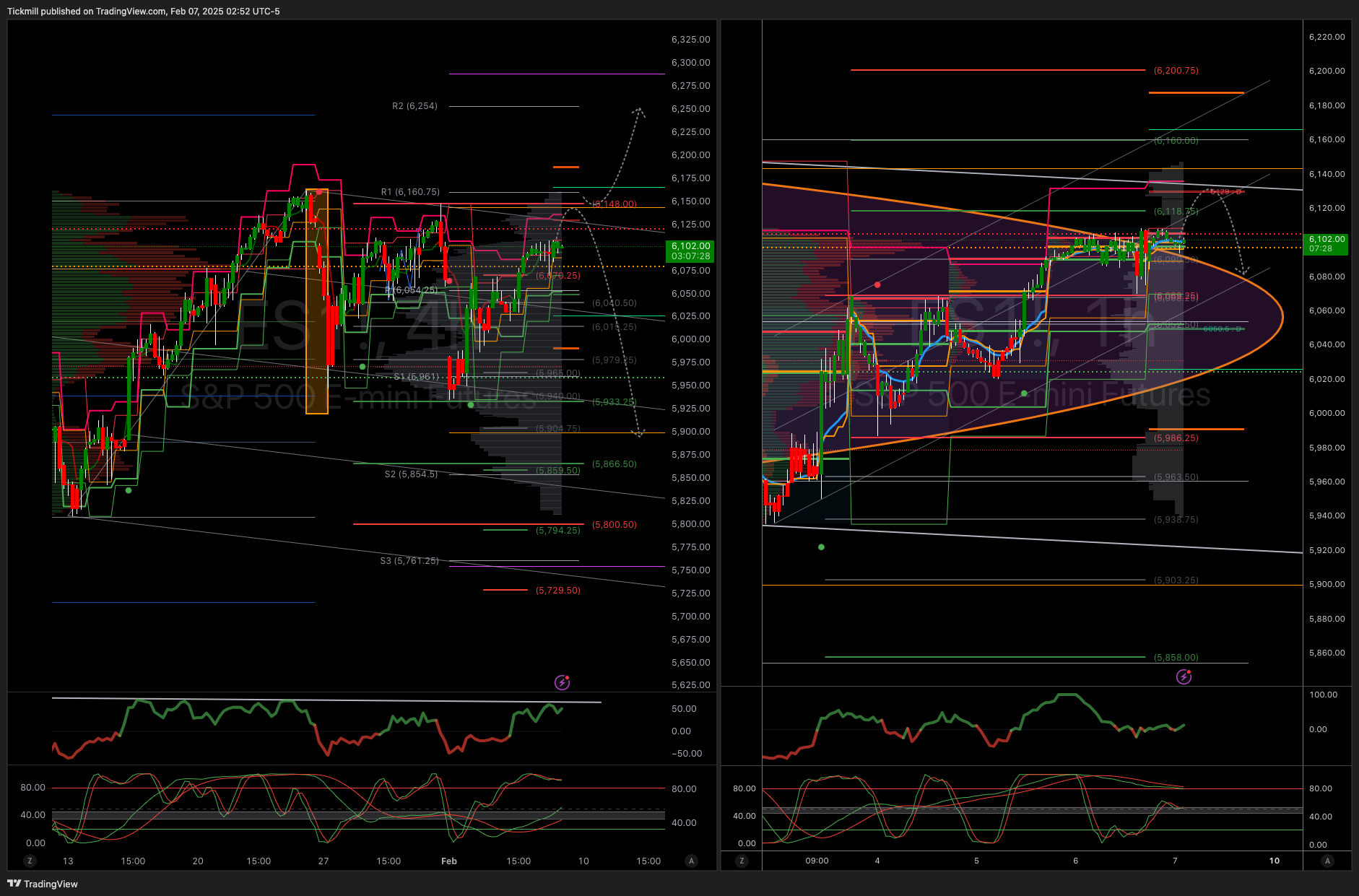

WEEKLY BULL BEAR ZONE 5900/5890

WEEKLY RANGE RES 6086 SUP 5878

DAILY BULL BEAR ZONE 6058/68

DAILY RANGE RES 6136 RANGE SUP 6052

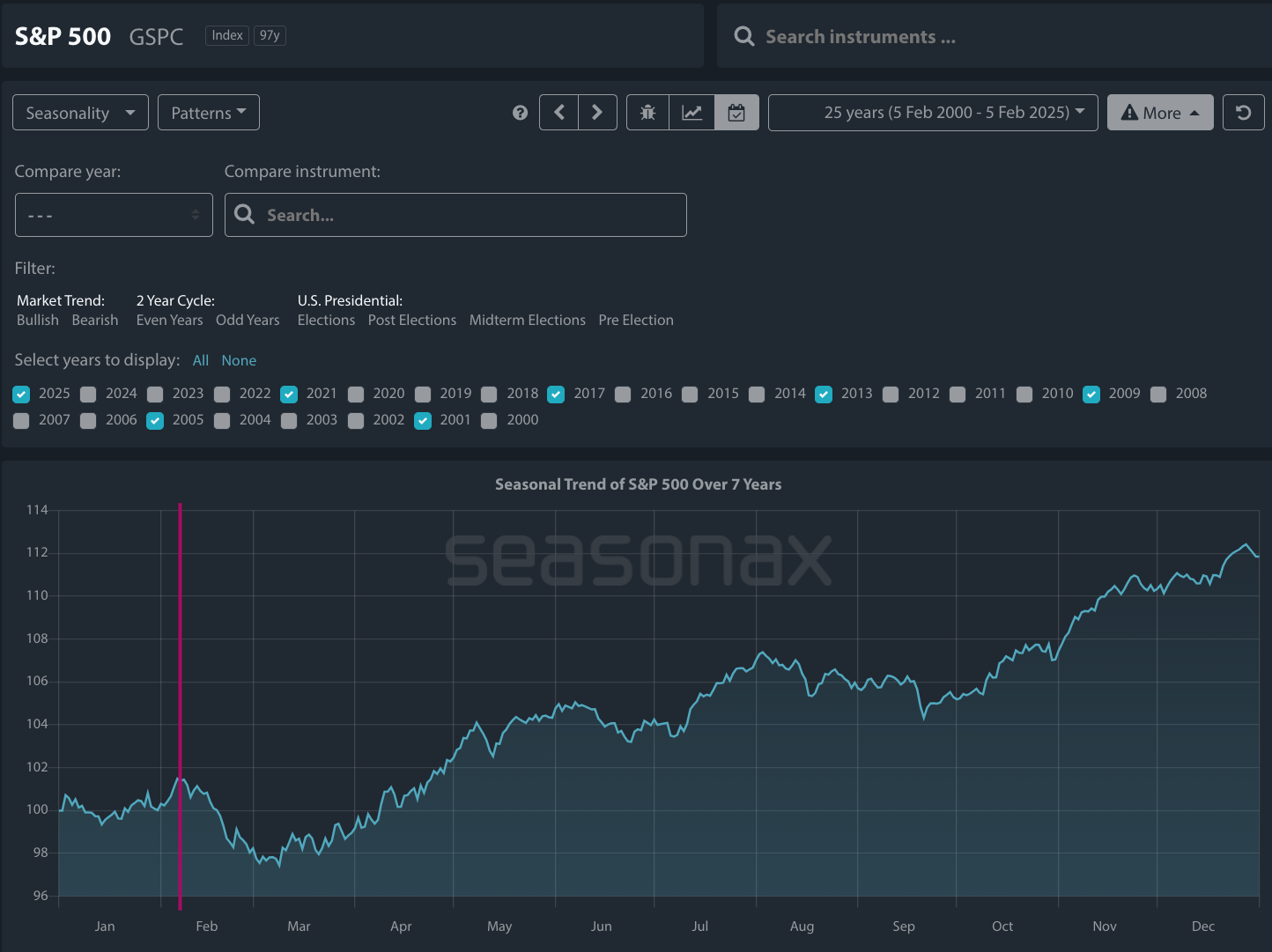

***NOTE WE ARE HEADING INTO A WINDOW FOR POTENTIAL EXTENDED VOLATILITY FROM TOMORROW AS OUTLINED IN THE WEEKLY VIDEO UPDATE BELOW - PERSONALLY WILL BE LEANING INTO RANGE/STRUCTURAL RES IN COMING SESSIONS - I HAVE AMENDED MY STOP TO B/E ON THE 6141 SHORT TO ACT AS A CORE SWING POSITION TO TRADE AROUND INTO THE BEGINNING OF MARCH - REMEMBER VOLATILITY DOES NOT IMPLY CRASH CONDITIONS, WE CAN WITNESS LARGE SWINGS WITHIN A PULLBACK - I WILL CONTINUE TO TRADE FROM BOTH LONG AND SHORT SIDE INTRADAY AT MY LEVELS, BUT MY BIAS WILL BE TO LEAN HEAVIER AGAINST RESISTANCE.***

TODAY'S TRADE LEVELS & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT OF DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

YOU CAN REVIEW WEEKLY ACTION AREAS & PRICE OBJECTIVE VIDEO HERE

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES SUMMARY: RANGE-BOUND

FICC and Equities

6 February 2025 | 10:14PM UTC

S&P rose by 36 basis points to close at 6083 with a market-on-close buy of $4.4 billion. NDX increased 54 basis points to 21774, R2K gained 39 basis points to 2307, and the Dow was up 28 basis points to 44747. A total of 13.63 billion shares exchanged hands across all U.S. equity markets, compared to a year-to-date daily average of 16 billion shares. The VIX increased by 171 basis points to 15.50, crude oil was down 72 basis points to 70.52, the U.S. 10-year yield rose by 2 basis points to 4.43%, gold was down 41 basis points to 2855, the DXY rose by 10 basis points to 107.69, and bitcoin decreased by 49 basis points to 96462.

Equities ended the day slightly higher after a session of range-bound trading. Activity was focused on minor movers influenced by earnings reports. Bond markets remained stable, with the 10-year yield settling below 4.5% ahead of employment data to be released tomorrow, with whispers suggesting around 200k jobs added. GIR predicts nonfarm payrolls increased by 190k in January, surpassing the consensus of 170k and aligning with the three-month average of the same figure. Alternative indicators of employment growth suggested solid job creation, and the rate of layoffs—which is crucial for net job growth in January—stayed low. We estimate that the Los Angeles wildfires and colder-than-normal weather might each deduct 20k from January's job growth

Our baseline assessment was a 6 on a 1-10 scale regarding overall activity levels. The total executed flow finished down 57 basis points compared to a 30-day average increase of 60 basis points, with skews remaining neutral. Liquidity providers ended as $800 million net buyers, showing demand across technology, consumer goods, and financial sectors, versus supply in macro products. Hedge funds were $600 million net sellers, with supply spread across almost all sectors, particularly concentrated in REITS (short more than long), Financials, and macro products.

Today's notable movers:

Trump and the GOP allegedly talked about removing the carried interest tax loophole to fund state and local tax deductions, which led to initial reactions from alternative investment funds. DeGrasse mentioned that these funds have since changed to C-corporations and are no longer impacted—only their employees would be affected. There was mixed feedback regarding whether these firms would need to raise compensation to counteract the higher taxes faced by employees. Additionally, Bessent commented that "China will end up absorbing quite a bit of tariffs."

DERIVATIVES:

Despite a late rally, the S&P intraday trading range was only 62 basis points, marking one of the narrowest ranges this year. The desk believes that dealer gamma sensitivity is increasing at the current market level and will likely persist as a buffer. Trading was largely quiet again, although we did observe some activity around AMZN’s earnings report tonight, with trading favoring buyers of downside protection ahead of the announcement. With the nonfarm payroll data on the agenda for tomorrow to conclude the week, the Friday straddle is forecasting a 0.75% movement.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!