“Symbolic” Iran Missile Strikes. Was It the Case?

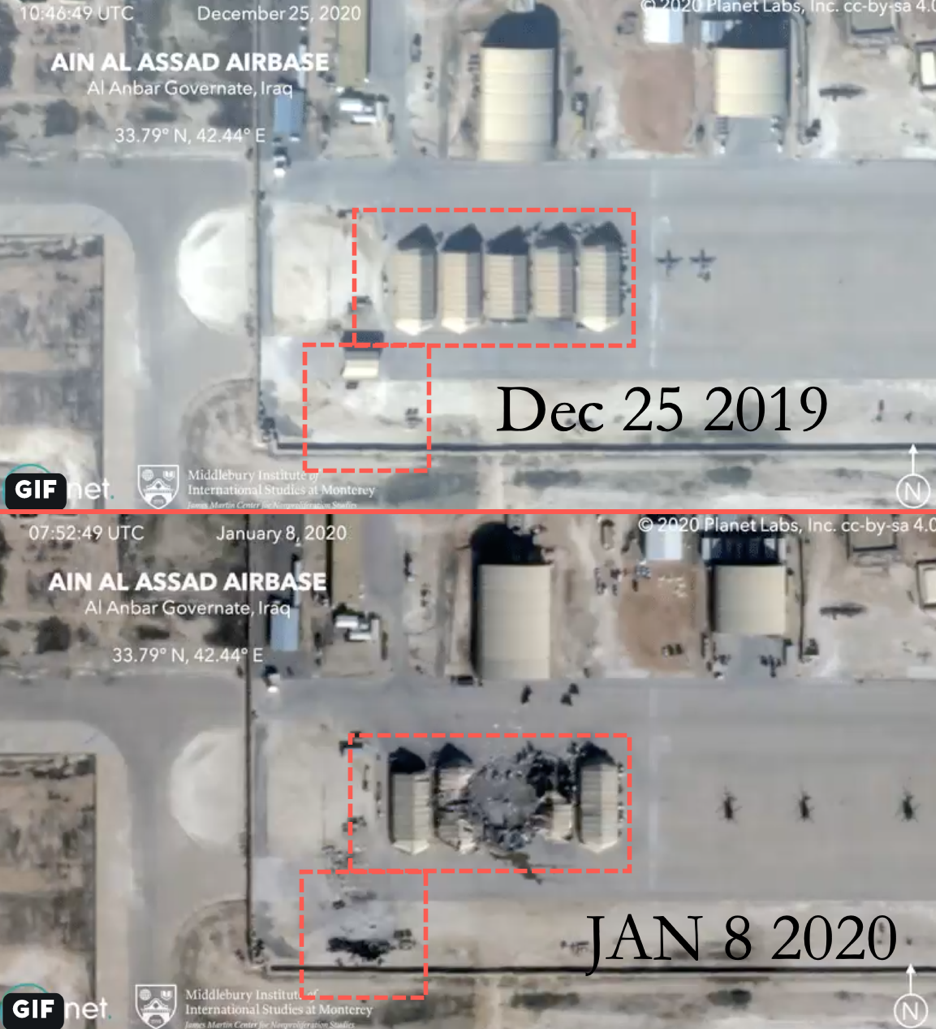

Iran’s "Act of severe retaliation" was surprisingly humane - missile attacks were carried out in such an amazing way that not a single American soldier was injured. However, contrary to the ironic media reports about the "symbolic strikes", “Iran’s notification of American troops about the strikes”, satellite images show that Iran deliberately targeted military capabilities and there was material damage from the strikes:

Middlebury University expert David Schmerler said that if Iran wanted to destroy the equipment it accomplished the task.

Gold fell immediately after “informed sources” tweets appeared claiming there were no casualties from the military strikes. Trump statement made later was basically redundant, it was obvious that the military response won’t make sense. Trump said something like “we have excellent weapons, but we have not and do not want to use it” and ordered to slap Iran with new sanctions. That’s it. Basically, I supposed that de-escalation would quickly become the base case because there were strong signs that Iran don’t want direct confrontation and indeed it happened and killed last “doomsayers” in the gold market.

Price broke through $1,550 per troy ounce, speaking in favor of the fact that only speculators and those “who expected World War III" bought gold when it rose above $1,550. In the short-term I expect gold to move lower towards the range of $1,535- $1,540 if Friday NFP indicate that the labor market continued to remain strong.

Brexit

Here we go again. Michel Barnier said on Thursday that the deadline for making a new comprehensive agreement that would regulate relations with independent Britain would take more than 11 months (the transitional period after Britain leaves the EU at the end of January), which sent GBPUSD lower to the vicinities of 1.30.

In my opinion, GBP reaction to the Barnier’s words is irrational, since even if the countries do not fit into the transition period, special conditions (for example, preferential tariffs) will be extended for additional time, as otherwise uncertainty and deterioration of corporate confidence are inevitable, which no one needs now and will want to avoid in the future. Many of the delays that EU granted to Britain during Brexit deliberations basically confirm the EU’s desire to make everything smooth with UK.

If tomorrow conditions after NFP satisfy, a drop of GBPUSD below 1.30 could be a great opportunity to consider long positions on the pair.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.