The IndeX Files 27-08-19

Trump V China

Its been an interesting start to the week for equities. Despite the quiet summer trading conditions, developments at the G7 meetings over the weekend, concluding yesterday, have yielded important outcomes. On Friday, markets were shunted lower as China announced that it will proceed with tariffs of as much as 10% on $75 billion worth of U.S. goods in retaliation for President Donald Trump’s threats to impose new duties on Chinese goods from September 1st.

Trump then responded swiftly by saying that he would order US companies to cease operating in China, effectively severing all trade links with the nation, while calling premier Xi an “enemy” of the US. Following the backlash against his comments, which included criticism that Trump would not be able to follow through on his threats, Trump used Twitter to say “For all of the Fake News Reporters that don’t have a clue as to what the law is relative to Presidential powers, China, etc., try looking at the Emergency Economic Powers Act of 1977. Case closed!”

However, markets were then buoyed yesterday as Trump seemed to totally reverse his initial sentiment, saying that he was confident that the two sides would do a “great deal” and called Xi a “great leader”. Speaking as the meetings came to a close yesterday Trump said:“We were called and we’re going to start very shortly to negotiate. We’ll see what happens, but I think we’re going to make a deal. This the first time I’ve seen them where they really want to make a deal.”

Chinese VP Calls For Calm

These comments come on the back of a speech by Chinese vice premier, Liu, which also helped assuage fears stoked by Friday’s escalation. Liu said “We are willing to resolve the issue through consultations and cooperation in a calm attitude and resolutely oppose the escalation of the trade war. We believe that the escalation of the trade war is not beneficial for China, the United States nor to the interests of the people of the world.”

Central Bank Easing Expectations

Markets are also being buoyed by increased expectations of further central bank easing. In Europe, markets are widely expecting the ECB to announce a package of measures at its upcoming meeting in September, in line with the release of the July meeting minutes. The minutes showed the majority of members back a range of options instead of a single action.

In the US, traders are expecting the Fed to ease further in September also given the ineffectiveness of the fed’s .25% rate cut in July and the deterioration in global conditions since that time. Indeed, speaking at the Jackson Hole Symposium on Friday, Fed chairman Powell kept further rate cuts firmly on the table though warned of the bank’s limited effectiveness to combat the downside impact from Trump’s trade war.

Technical Perspective

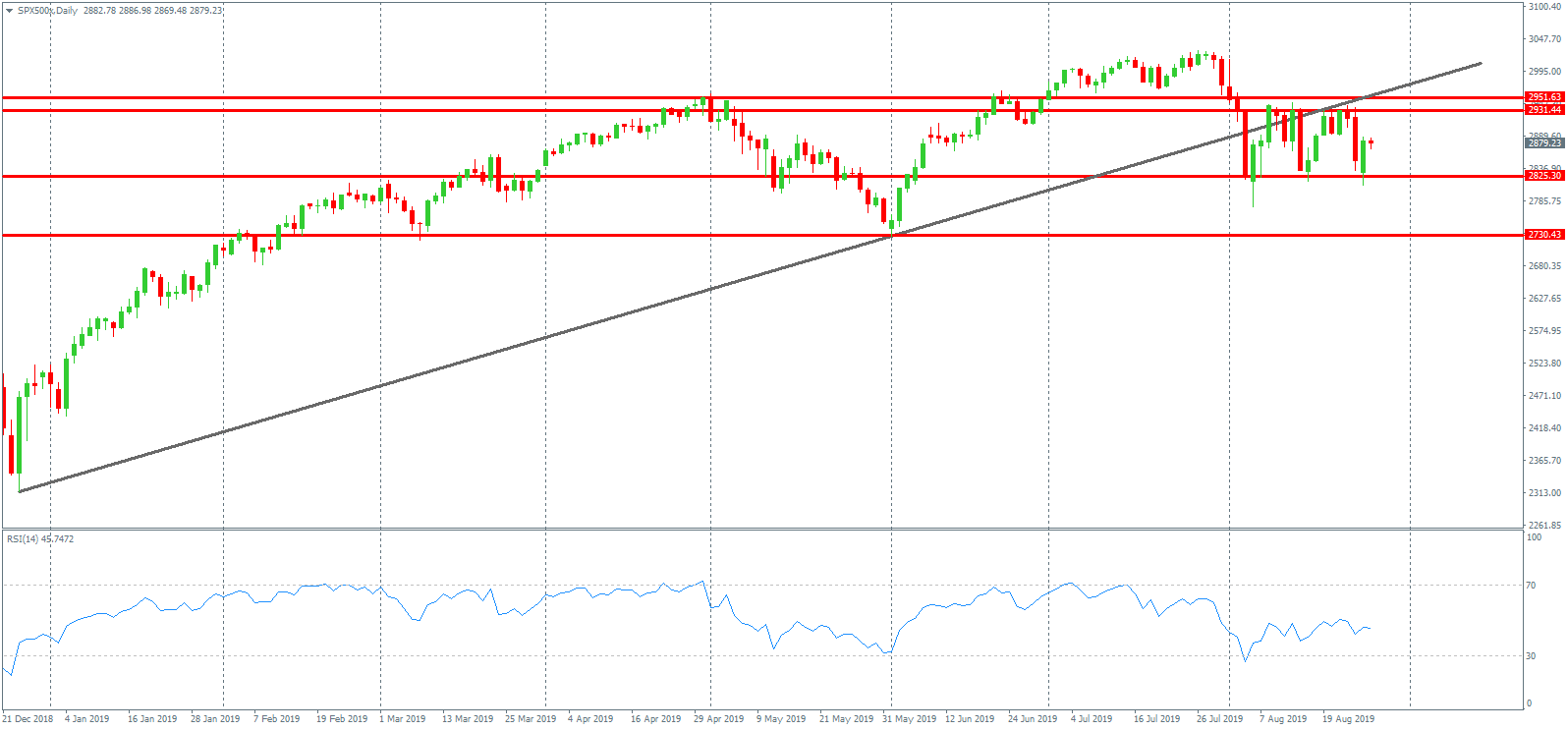

S&P 500

The index has been range bound between the 2825.30 level support and resistance at the 2931.44 – 2951.63 level, which also held the retest of the broken trend line from 2018 lows. Range trading continues while these levels remain intact though an eventual move back to the topside seems likely given the building expectations of further easing from the Fed. However, any breakdown in US / China talks could quickly see a jolt down to 2730.43 next, so downside do remain.

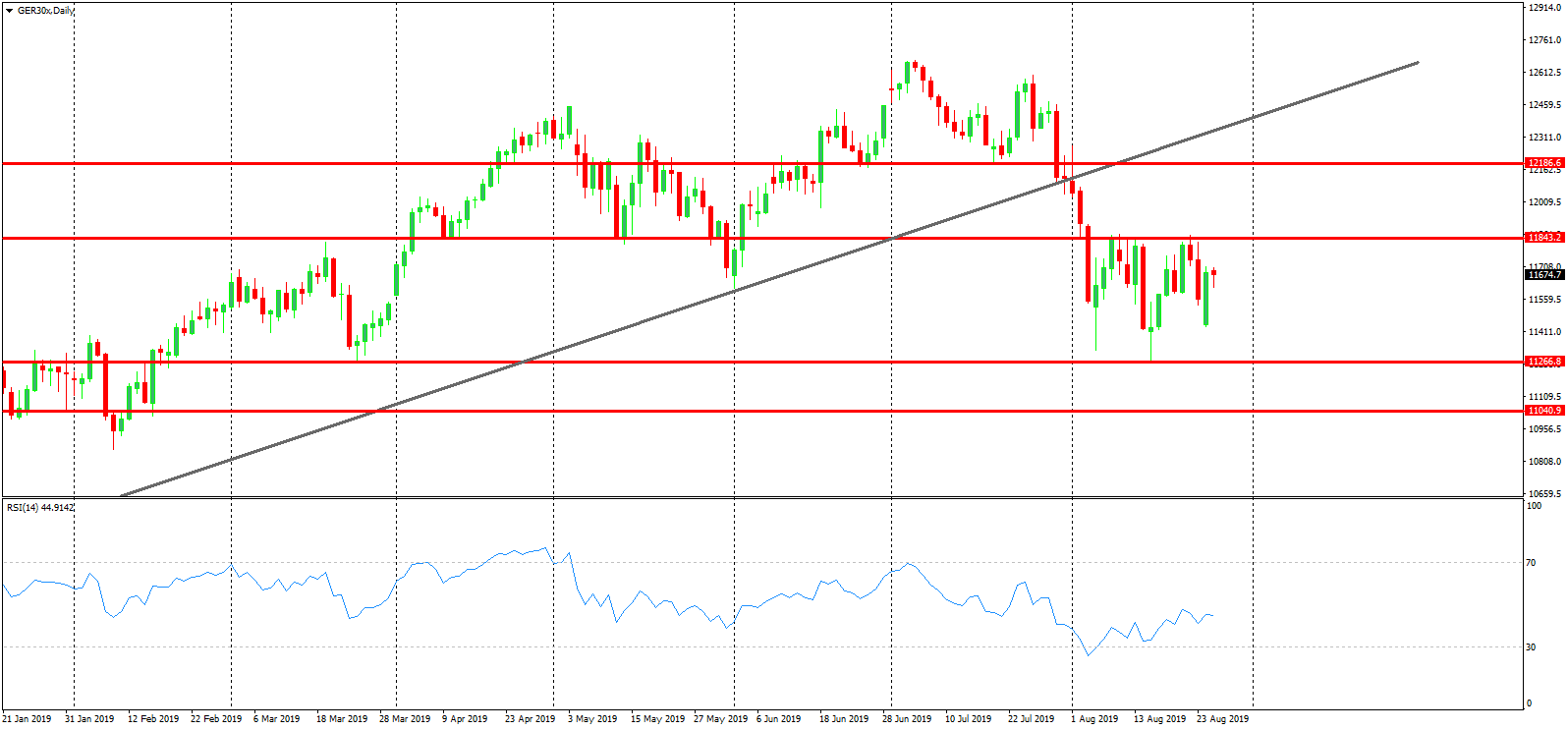

The DAX

For now the DAX continues to range between support at the 11266.8 level and resistance at the 11843.2 level. The market has spent most of August here following the break down below the rising trend line from 2018 lows, which as yet remains untested. To the downside, any break lower will put the focus on a test of the 11040.9 level next.

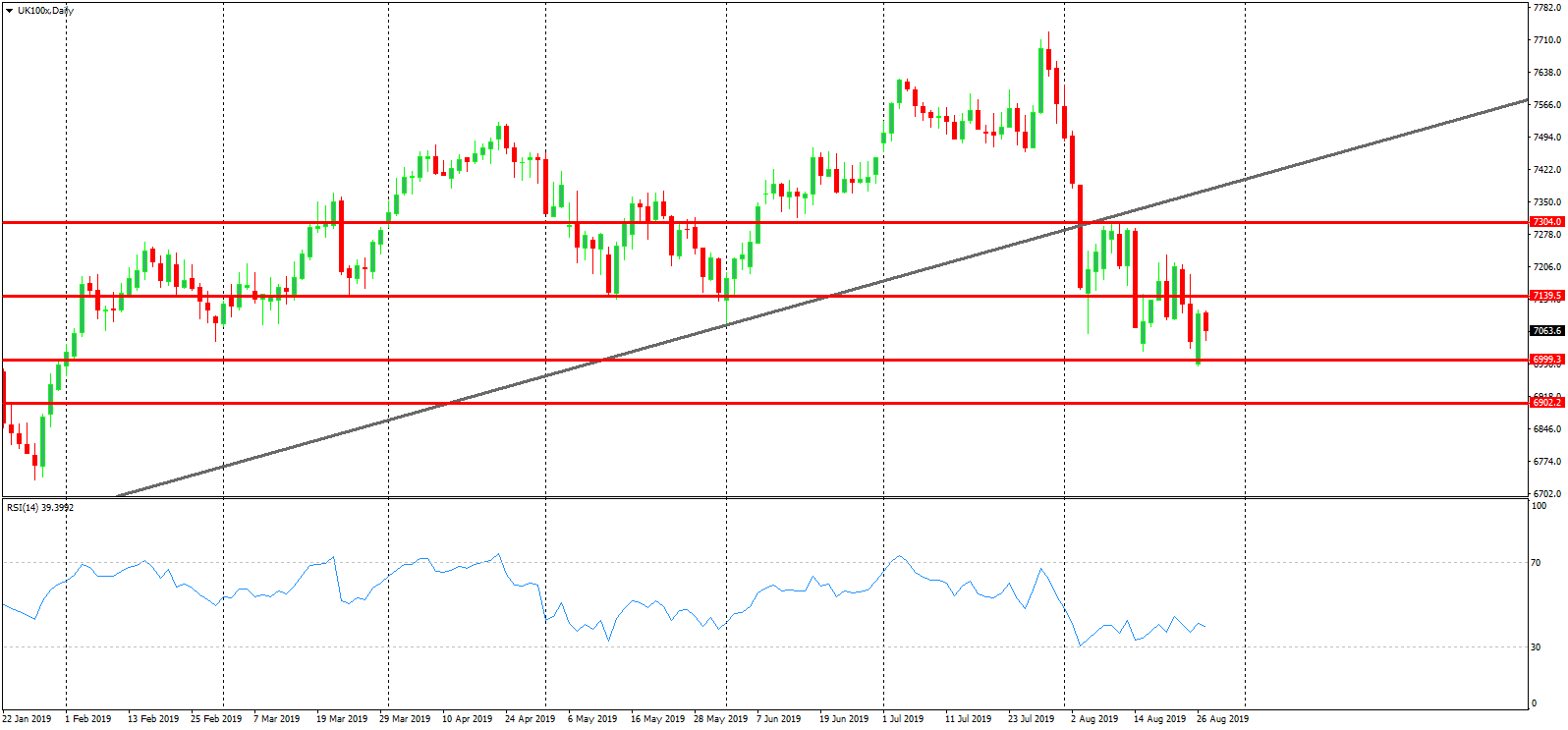

FTSE 100

The break below the rising trend line from 2018 lows earlier this month has seen price trading down as low as the 6999.3 level, which has held as support for now. However, the move has lost momentum recently and with the RSI indicator flagging bullish divergence, there is the growing risk of a topside squeeze with 7304. The key level to watch in the near term.

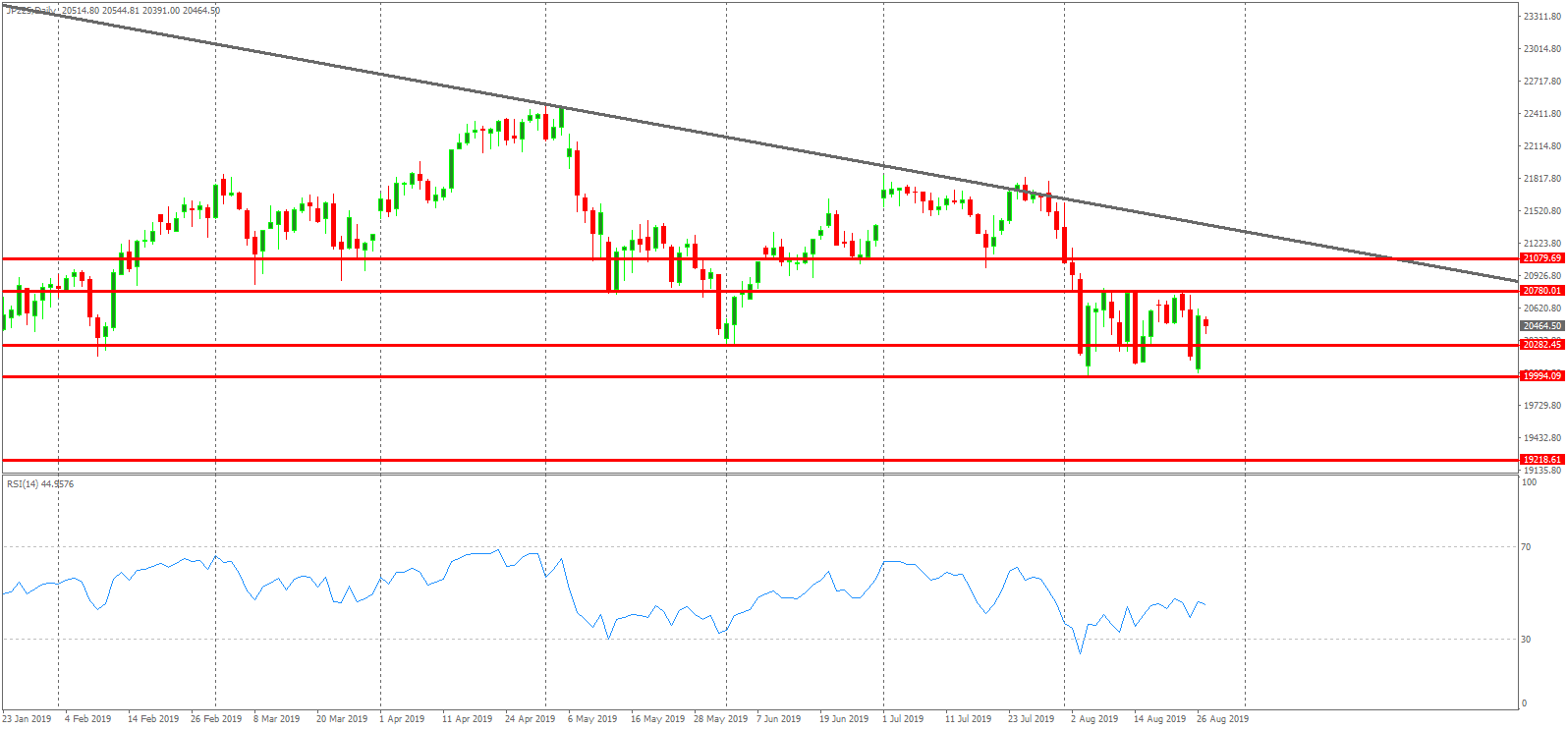

Nikkei 225

The Nikkei continues to range within the tight block of consolidation between the 19994.09 – 20780.01 levels. Momentum has dried up, however, the bearish trend line from 2018 highs suggests the risk of an eventual downside break, putting focus on a test of the 19218.61 level next.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.