US Treasury Yields Respond to Labor Market Data and Economic Signals

The yields on US Treasury bonds hit a local minimum on Tuesday following the release of JOLTS data on job vacancies:

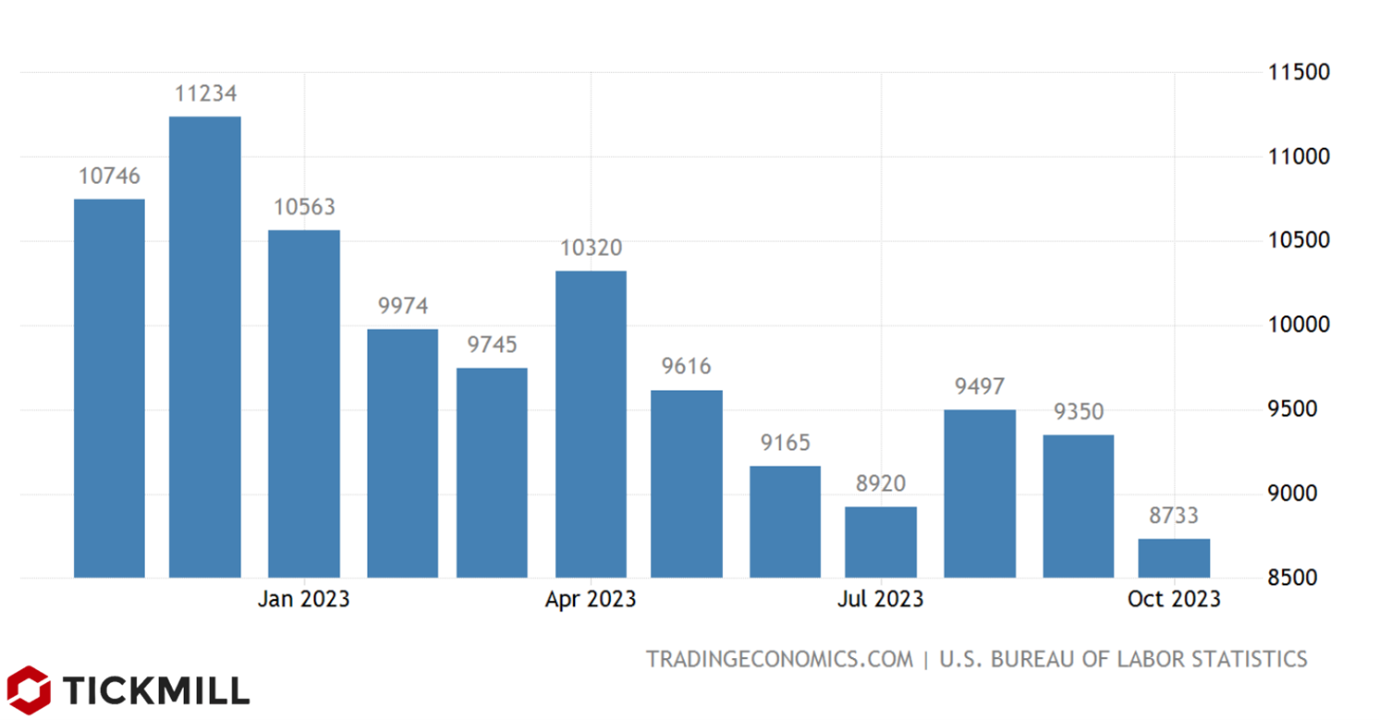

The 10-year bond yield dropped by approximately 5 basis points after October's job vacancy data revealed a more significant decline in labor demand than expected. The number of job openings fell from 9.35 million in September to 8.7 million in October, contrary to the anticipated slight decrease to 9.3 million. With supply chain disruptions and firm inventories normalizing, the focus on the trajectory of inflation uncertainty has shifted entirely to consumer demand and labor market imbalances, particularly workforce shortages resulting from COVID-related restrictions.

The narrative of a labor shortage in the United States has been unfolding since mid-2021, making labor market indicators such as the JOLTS report particularly crucial in understanding the evolving dynamics. The chart below illustrates the trend in job openings throughout the year.

Throughout the year, the number of job openings steadily decreased, with signs of a trend reversal in August and September, coinciding with a significant sell-off in Treasuries triggered by concerns about the return of inflation. However, in October, the indicator returned to a downward trajectory.

As the number of job openings decreases, firms face less competition for qualified employees, reducing the need to raise wages. This, in turn, dampens future inflation both through firm costs and slower consumer income growth.

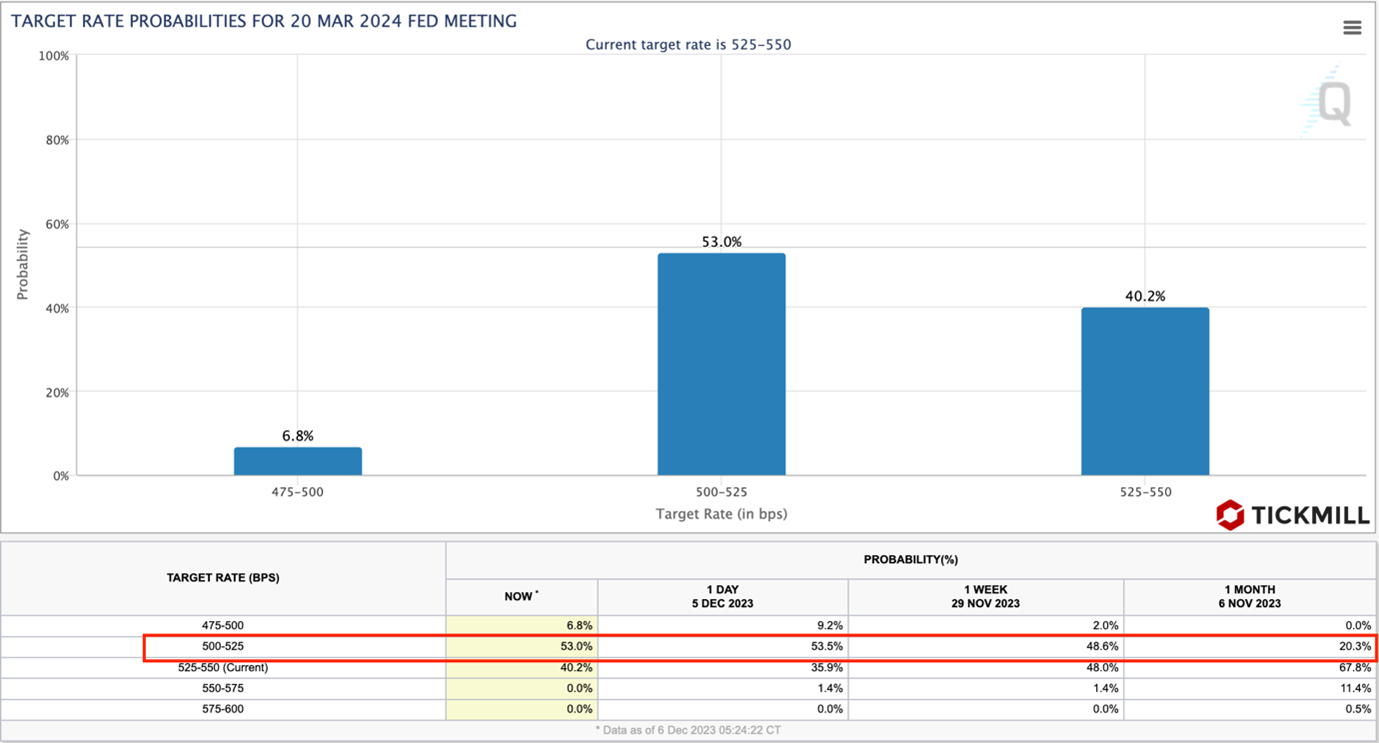

Another critical report released yesterday was the ISM Services Activity Index, indicating how individual components of sector activity—hiring, new orders, investments, prices paid—change from month to month. In November, the index rose to 52.7 points, surpassing the forecast of 52. This suggests not only an increase in sector activity but also a growth rate slightly above expectations and the pace of the previous month. The data proved to be better than expected, likely preventing a more substantial decline in bond yields that would have indicated market participants' confidence in the Federal Reserve reducing rates in March 2024. Over the month, the probability of such a scenario increased from 20.8% to 53%, making it the baseline expectation:

Today, there is a risk of a resumption of the decline in risk-free market rates in the US, associated with the release of the ADP report. A modest growth of 130,000 jobs is expected in November, following 115,000 in October. The market will also pay attention to changes in mortgage applications and US external trade statistics (export/import), which will be released later today.

Expectations that the main opponent of the Federal Reserve, the ECB, will also cut rates are growing, possibly at an accelerated pace. ECB officials contribute significantly to this trend. Yesterday, a representative of the ECB, Schnabel, stated that further tightening of the central bank's policy is unlikely, reinforcing market expectations that the ECB will cut rates by 125 basis points in 2024. Federal Reserve officials attempt to avoid such statements in their rhetoric and continue to assert that there is a possibility of another rate hike if inflation surprises again. However, if US labor market data (ADP and NFP) indicate a significant slowdown, European currencies may find an opportunity to latch onto previous upward trends.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.