Inflation Report Boosts Dollar, Fed's Pause Looms: Market Insights

The inflation report gave the dollar a little boost, causing it to gain almost half a percent against the euro and Swiss franc on Thursday. Commodity currencies took a hit alongside the commodity market, with the Australian dollar dropping by 0.7% and the New Zealand dollar by 0.4%. Despite an overall decrease in consumer inflation in the US during April, core inflation remained steady at 5.5%. The dollar gains ground without the help from equity market corrections and with the solid likelihood of the Fed taking a break in June (chances are now almost 100%), suggesting that the factors driving its performance lie in worsening growth prospects outside the US.

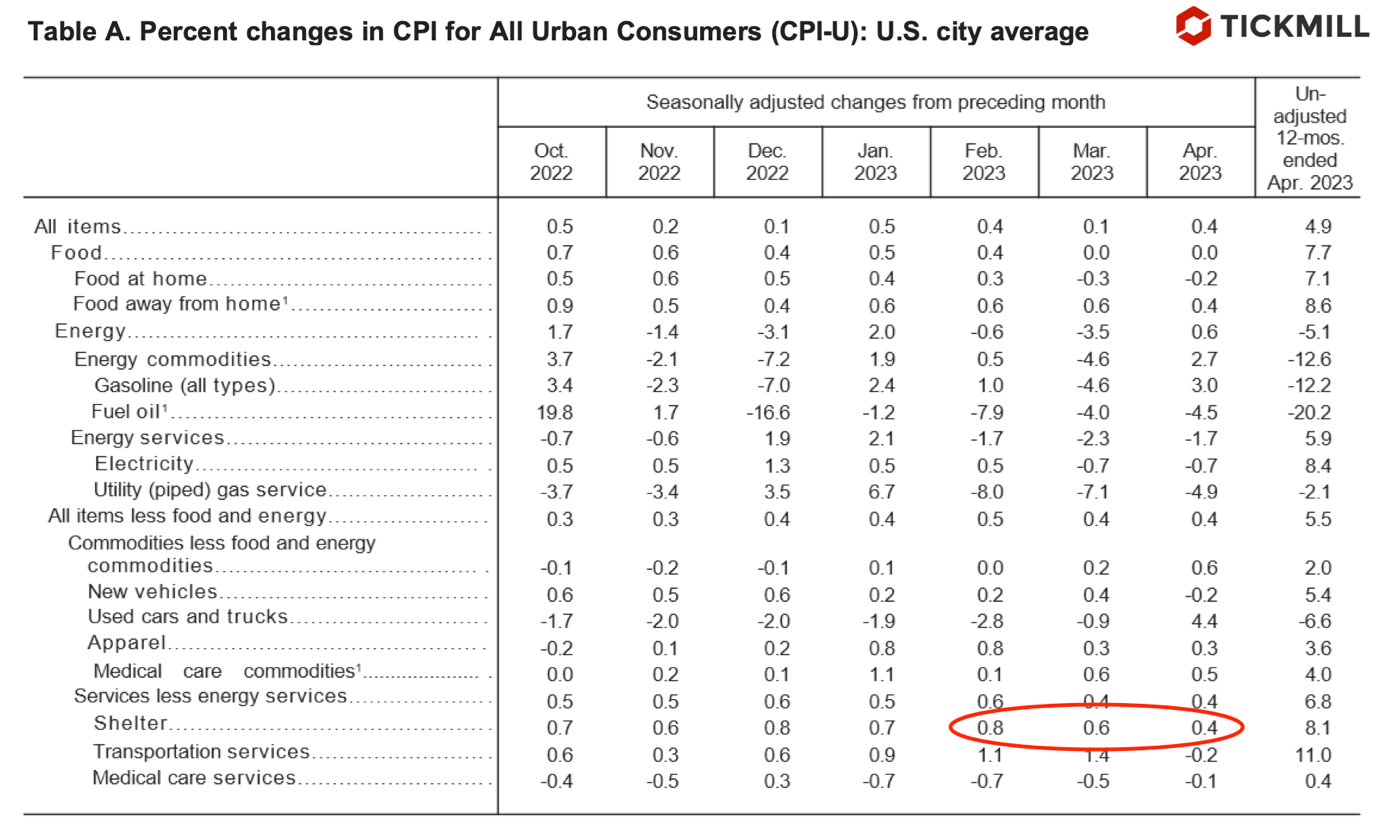

Yesterday's inflation report showed a drop in consumer inflation overall, but core inflation remained stable. However, a significant sign of decreasing inflation in the upcoming months was the consistent weakening of shelter inflation:

This component carries significant weight in the Consumer Price Index (CPI) and is one of the most influential factors (as rental prices follow housing prices, and contract terms lead to price stickiness). Additionally, it affects future inflation through inflation expectations. This isn't surprising considering that a considerable portion of consumer spending goes toward rent and housing maintenance.

Treasury yields slip reflecting the market's growing confidence that the Fed will announce a pause in June:

The Producer Price Index (PPI) didn't meet expectations, with a monthly price increase of 0.2% compared to a forecast of 0.3%. This further indicates a weakening consumer inflation since businesses will have fewer incentives to raise prices.

Today, the Bank of England raised interest rates by 25 basis points and stated that further increases are possible if inflation doesn't respond to policy changes. The central bank revised its economic growth forecast to higher values, and the "boost in optimism" is the strongest since 1997. Market participants suspect that the central bank won't stop and will raise rates up to 5%. Looking at the technical chart for GBPUSD, the price has approached a crucial bearish line. If it breaks through and consolidates above this line successfully, it could easily gain bullish momentum. The presence of a hawkish central bank, as revealed in today's meeting, serves as a foundation for a bullish Pound outlook:

Отказ от ответственности: предоставленные материалы предназначены только для информационных целей и не должны рассматриваться как рекомендации по инвестициям. Точка зрения, информация или мнения, выраженные в тексте, принадлежат исключительно автору, а не работодателю автора, организации, комитету или другой группе, физическому лицу или компании.

Прошлые результаты не являются показателем будущих результатов.

Предупреждение о рисках: CFD-контракты – сложные инструменты, сопряженные с высокой степенью риска быстрой потери денег ввиду использования кредитного плеча. 72% и 73% розничных инвесторов теряют деньги на торговле CFD в рамках сотрудничества с Tickmill UK Ltd и Tickmill Europe Ltd соответственно. Вы должны оценить то, действительно ли Вы понимаете, как работают CFD-контракты, и сможете ли Вы взять на себя высокий риск потери своих денег.

Фьючерсы и опционы: торговля фьючерсами и опционами с маржей несет высокую степень риска и может привести к убыткам, превышающим ваши первоначальные инвестиции. Эти продукты подходят не для всех инвесторов. Убедитесь, что вы полностью понимаете риски и принимаете соответствующие меры для управления своими рисками.