Covid-19 Theme is Back Into Headlines?

Growing signs that major governments started to dial back economy reopenings suggest Covid-19 topic is back, starts to make headlines again and sow the seeds of distrust in global recovery.

Germany included 11 EU regions in the high-risk list for travelers as the incidence rate is increasing in the EU. This suggests soft travel curbs are coming and of course it causes disappointment in the markets.

France closed bars and restaurants in Marseille, Paris is on high alert. The French government will soon announce new restrictions. Nothing shocking is expected, but the pressure on business, especially in services sector, appears to be growing.

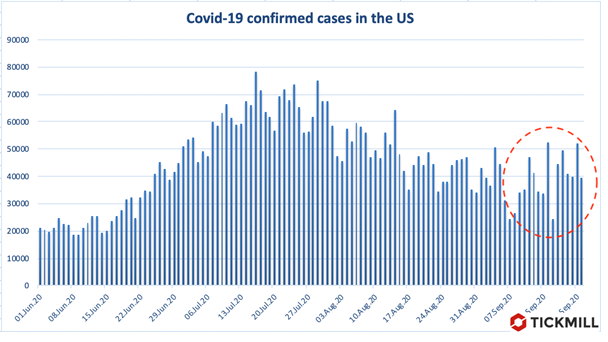

Total number of cases in the US exceeded 7 million. The daily gain appears to have bottomed out and show signs of acceleration in September, which may start to unnerve the markets:

Bloomberg says the US administration is set to increase funding for projects that will accelerate the development of a vaccine for Covid-19 by reducing expenditures on testing and masks. The size of the program increased from $10 billion to $18 billion.

First results on clinical efficacy of vaccines from major developers should start to appear only in October-November, i.e. we won’t get news on key bullish drivers for some time and its bad for the markets.

Markets sluggishly decline on Thursday, as the topic of a lockdown, as well as the lack of government support for large economies, fading old stimulus appear to be holding back optimism. However, as we can see, buy the dip forces are still strong so it’s important to keep that in mind evaluating depth of drawdowns.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.