Dollar Slips on Weaker Jobs Insights

DXY Cooling From Highs

Following a firm move higher over the last week the Dollar was seen reversing heavily lower yesterday. A hawkish surprise from the Fed last week, with Powell casting doubt on a December rate cut, sparked a fresh rally in USD. However, the move was seen reversing yesterday as traders reacted to a rise in the challenger layoff data. Amidst the ongoing US govt shutdown, the lack of public sector data means traders have been relying on private sector readings. While the ADP print on Wednesday was above forecasts, yesterday’s data painted a different picture showing a surge in layoffs as a result of AI adoption and cost cutting operations. There was also chatter over some alternative data doing the rounds suggesting the October NFP (which would have been released today) would have fallen by around 9k.

December Easing Expectations

Yesterday’s data has seen pricing for a December rate cut rising back up to 65% from around 60% prior, showing that forecasts are still leaning into dovish territory for now. Speaking yesterday, Fed’s Goolsbee echoed the sentiments expressed by Powell last week saying that he is inclined to take a more cautious approach on furtehr easing given the lack of visibility at the moment due to the absence of hard data.

Shutdown Talks

Looking ahead, traders will be watching for any signs that the shutdown is coming to an end. Senators are due to meet for talks this weekend, so we could see some market moving headlines if any progress is made. Ultimately, while the shutdown persists, a December cut hangs in the balance and USD will likely be shunted around by Fed comments and any incoming private sector data.

Technical Views

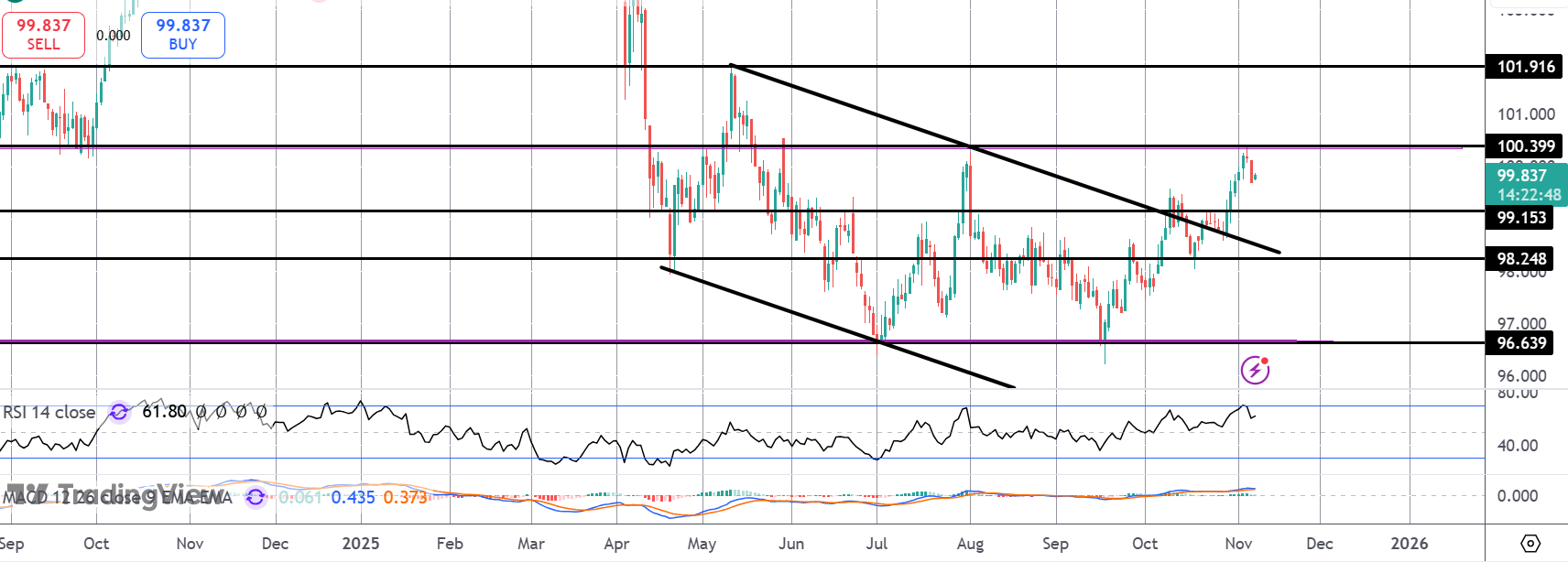

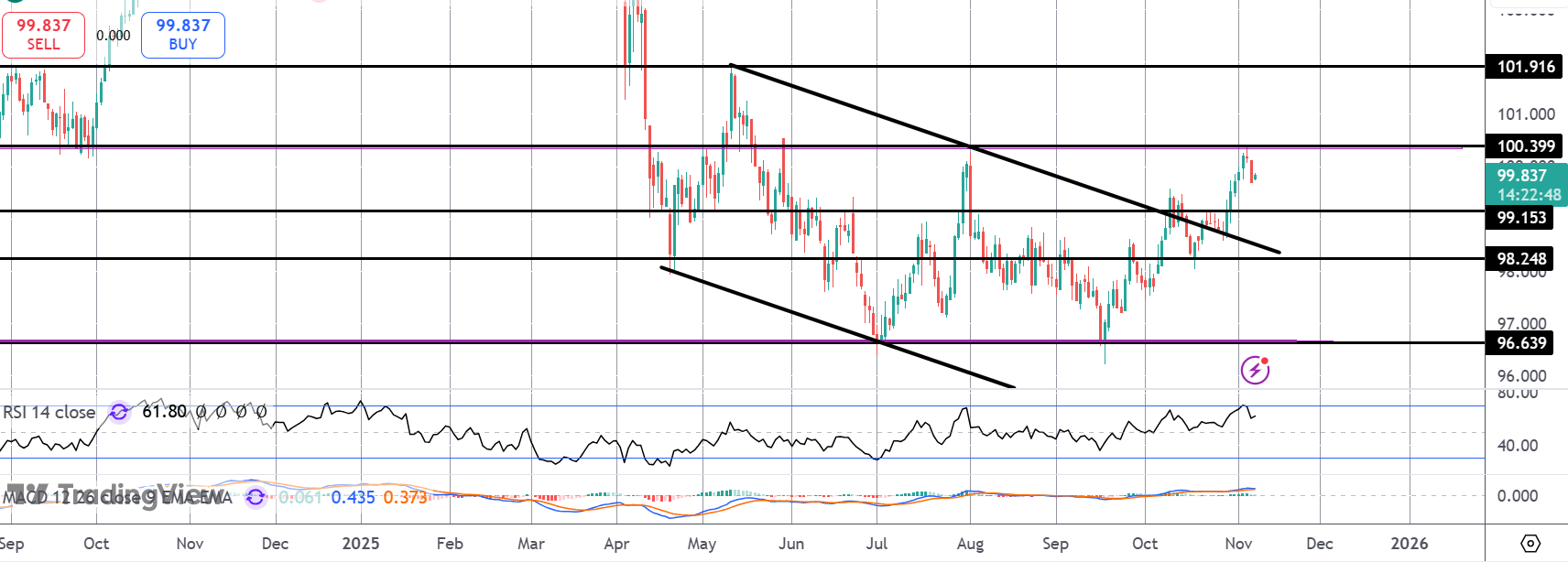

DXY

The rally in the index has stalled for now into a retest of the August highs around the 100.39 level. With momentum studies cooling a deeper correction lower is feasible. However, while the 99.15 level holds the focus is on a continuation higher with the 101.91 level the next target for bulls.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.