Rising Bond Yields in the US can Trigger Fed Response

The sell-off in US Treasuries gains steam, challenging one of the key narratives of support for stocks that bonds are now completely unattractive compared to equities. The moment when bonds start to lure investors out of stocks seems to have arrived: the yield on 10-year Treasuries jumped over 1.3%, which became a catalyst for decline in stock indices on Tuesday and Wednesday.

US tech sector were hit the most as it is loaded with growth stocks, which are the closest investment substitutes to bonds. Why? Like long-term bonds, they have high duration i.e., the degree how stretched are an asset’s cash flows in time:

In addition, the biggest shift in term structure of risk-free rates is happening in the long-end of the yield curve – long-term rates are rising fast while short rates (like 1Y, 2Y Treasury rates) remain relatively fixed due to the Fed policy. It means that the present value of distant cashflows on an asset should suffer more now. Therefore, assets with higher weight of distant payments in their cashflows should be more vulnerable to the current rising trend in Treasury yields.

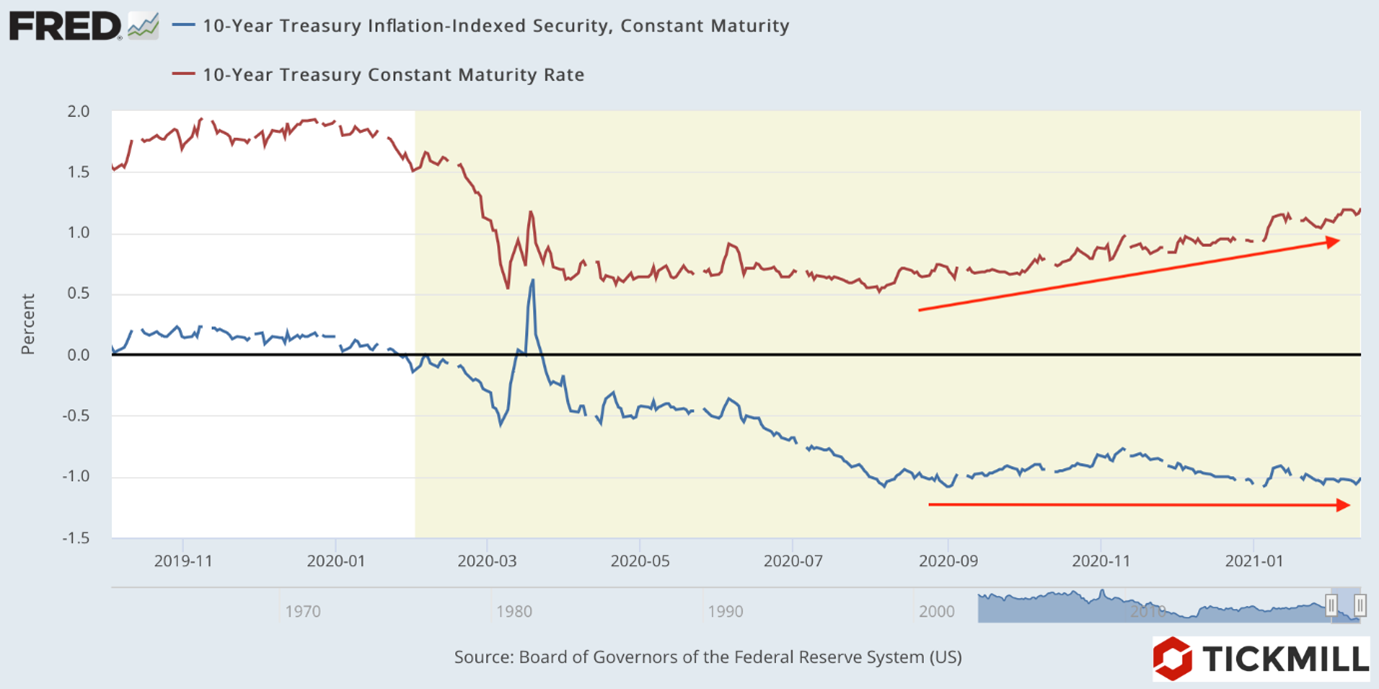

It should be noted that although the yield on 10-year Treasuries is rising, the yield on Treasuries with the same maturity, but protected from inflation (TIPS), remains stagnant (near -1%). In other words, it is not the real rate in the United States that is rising, but the market inflation expectations, which are usually hedged by gold purchases. In this regard, the recent decline in gold does not really fit into the picture of what is happening in the Treasury market:

The capital outflow from the Treasury bond market increased the demand for dollars, which led to a massive strengthening of the American currency. The dollar index bounced from 90.10 yesterday and rose to 90.82 on Friday.

All the attention now is on the Fed's reaction to the rise in bond yields. One of the goals of the Central Bank is to maintain comfortable costs of borrowing in the economy, including long-term borrowing costs, therefore, dangerous rise in yields should be tamed by the Fed. The question is when will this happen.

The main risk events, scheduled for today - release of the report on retail sales in the US for January and the minutes of the Fed meeting. The bond market should remain weak as retail sales are likely to post a positive surprise due to the boost from stimulus checks that US households received in January. The Fed protocol may contain a sell-off in the Treasury market, as it should indicate the willingness of the Central Bank to maintain soft credit conditions.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.